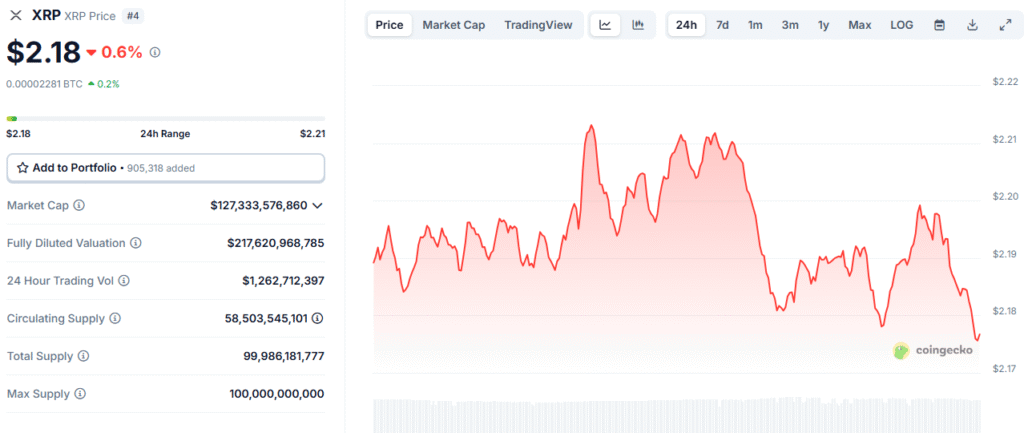

XRP is not playing games right now — and the charts are getting spicy.

After a massive 350% rally, XRP is entering uncharted bullish territory — and this time, it’s being powered by real demand, not degens flipping leveraged longs.

Spot Premium = Real Demand Energy

For the first time ever, XRP’s spot price is consistently above its perpetual futures — aka, we’re in its strongest-ever spot premium phase, according to market analyst Dom on X.

That’s a major signal: In past cycles, the token pumps were fueled by futures markets, aka speculative leverage bros. This round? It’s the real ones — actual spot buyers — moving the price. Translation? Way less risk of a brutal whiplash dump.

Whales Are Gobbling Like It’s Discount Season

Data from Glassnode backs the vibe: Since November 2024, wallets holding 10K+ token have been rising, even when price dipped 35% from Jan to April. That’s classic smart money behavior — load up during the quiet times before liftoff.

Oh, and don’t forget the macro fuel: The SEC dropped its lawsuit against Ripple, and the possibility of a spot XRP ETF has the market feeling ✨ bullish ✨ again.

Chart Pattern Screams Breakout Incoming

The weekly chart is screaming falling wedge breakout, which is usually a bullish reversal sign. Right now, it is eyeing $2.52 as the key resistance. If it clears that?

We could see it blast toward $3.78 by June — that’s a juicy 70% upside from today’s $2.17.

But if it stumbles? Price could dip back to the wedge’s lower bound around $1.81 before making another breakout attempt — still keeping the $3 target in play by summer.

You might find interesting: 5 Big Moves Vitalik Just Dropped to Make Ethereum Way Less Messy (And Way More Powerful)