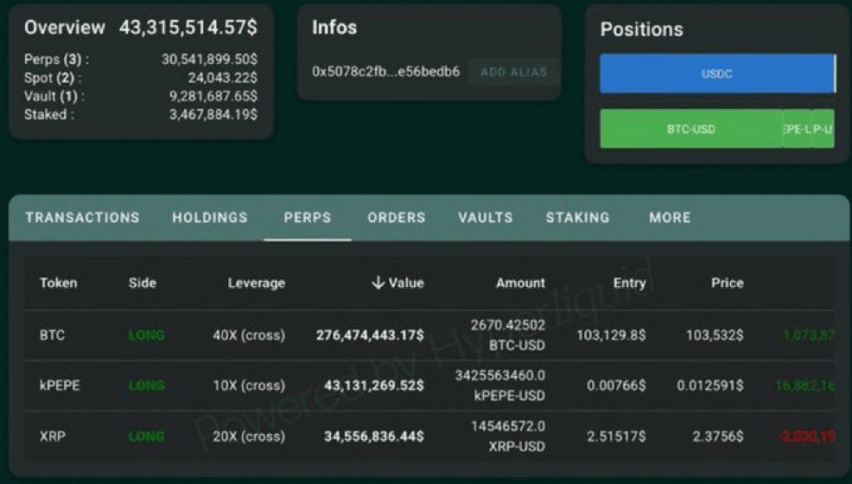

A major crypto whale has made headlines by opening an eye-popping $276.47 million long position on Bitcoin using 40x leverage through the decentralized perpetuals exchange, Hyperliquid. The highly leveraged trade, opened at a BTC price of $103,129.80, places the whale’s liquidation point at just $95,000 — making this one of the riskiest yet most talked-about bets in the current crypto landscape.

Ultra-Leveraged Bet on Bitcoin

The position involves 2,670 BTC and is one of the largest open on-chain trades visible today. With 40x leverage, even a minor 2.5% price drop would liquidate the entire position. That tight margin makes this a bold and high-stakes move — either a huge payday or a rapid wipeout.

The trader’s wallet, labeled 0x507..6ebd6, also shows a diversified high-risk strategy with more than $43 million in other crypto derivatives. The whale holds a $43.13M long on PEPE with 10x leverage and $34.56M long on XRP at 20x leverage, signaling a strong belief in short-term bullish momentum across major tokens.

Previous Whale Bets Still Fresh

This isn’t the first time a whale has rolled the dice in grand fashion. Earlier in 2025, another investor opened a $524 million short position on BTC at 40x leverage. That trade, placed around $83,898, risked liquidation above $85,565 and was similarly flagged as a high-risk play by analysts.

Market at a Glance

At the time of writing, Bitcoin is trading at $103,094, reflecting a minor 0.9% dip over the past 24 hours. Daily trading volume has declined by 21%, landing at $37.42 billion, with the broader crypto market cap hovering around $2 trillion, according to CoinMarketCap.

This mega-leveraged bitcoin long trade is fueling speculation on what the whale knows — or if it’s simply a high-roller gamble on continued bullish momentum in the market.

YOU MIGHT ALSO LIKE: Tether’s Blacklist Lag Lets Hackers Move $78M in USDT Before Freeze