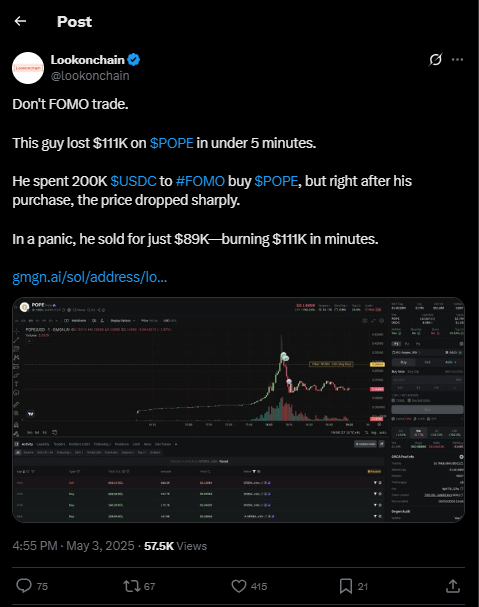

A crypto trader has become the latest cautionary tale in digital asset trading after losing $111,000 in just five minutes due to a rash FOMO-driven decision. The event underscores the harsh consequences of emotional trading in low-liquidity tokens, especially within meme coin circles.

Low Liquidity, High Risk: The Trader $POPE Incident

Blockchain analytics platform Lookonchain revealed that the trader spent 200,000 USDC to purchase POPE, a trending meme coin with low liquidity. Moments after the purchase, the token’s price plummeted, triggering a panic-sell. The trader liquidated their position for just $89,000, taking a staggering 55% loss in under five minutes.

The rapid collapse of POPE’s price reflects the inherent instability of small-cap altcoins, especially those driven by social media hype rather than fundamentals. These tokens are frequently targeted by whales and manipulators due to their ease of movement with relatively little capital.

The fear of missing out (FOMO) remains a leading psychological driver behind such trades. Investors, often influenced by online chatter and viral posts, dive into trending assets without due diligence. When prices inevitably reverse or manipulation kicks in, losses can be swift and devastating.

With the total crypto market cap now at $3.09 trillion, as reported by CoinGecko, opportunities for profit are abundant—but so are the risks. This incident serves as a reminder that speculative markets demand clear strategies and emotional discipline.

As meme coins like POPE continue to generate buzz, traders are urged to stay cautious, avoid impulsive entries, and always assess liquidity before making large trades.

YOU MIGHT ALSO LIKE:Breaking ! Cardano Could Hit $1.17 as ETF Approval Odds Reach 75%