Why the Solana Surge Is Real Right Now

If you’ve been anywhere near crypto Twitter or Reddit lately, you’ve seen it: Solana’s popping off again. No cap, it’s giving serious bull vibes in 2025. After lagging behind ETH for a minute, SOL is now sprinting. Why? First off, Solana just handled over 100 million transactions in a single day — and fees stayed stupid low. That’s wild when gas on ETH still costs more than your coffee.

But here’s the real sauce: devs are flocking to build on Solana again. We’re talking games, DeFi, NFTs — it’s all getting a second wind. With big players like Helium and Render moving their ecosystems to Solana, it’s clear people aren’t sleeping on it anymore.

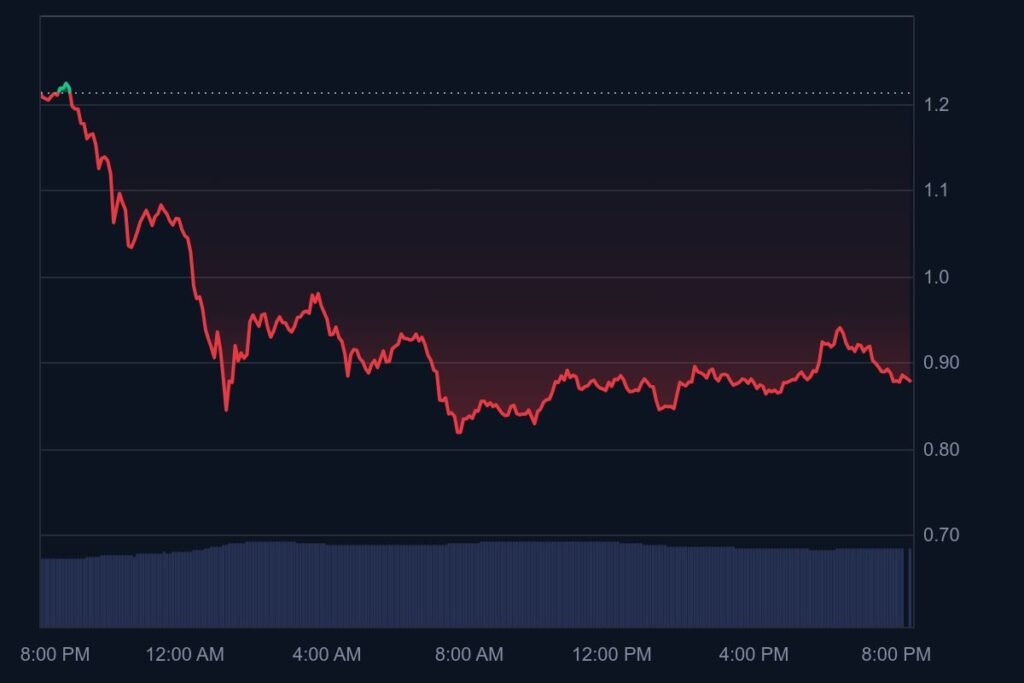

Also, SOL’s recent partnership with a major AI startup just hit headlines — and markets responded fast. The coin’s price jumped 15% in two days, and analysts say there’s more upside. If you’re the type that’s into flipping alts, SOL might be that move.

Look, nothing’s guaranteed in crypto. But the Solana Surge is more than just hype. It’s momentum with receipts.

If you’re trying to catch a wave before it goes full viral, you might wanna look into the way solana surge is taking place — but do your own research, always.

YOU MIGHT ALSO LIKE: Banxa Unlocks 1:1 RLUSD Support — Big Win for Global Crypto Payments