Three former crypto hedge fund executives—Patrick Horsman, Joshua Kruger, and Johnathan Pasch—are leading a Nasdaq-listed firm toward a $100M BNB acquisition. The company, still unnamed, will reportedly be renamed Build & Build Corporation once the deal closes later this month.

This would mark the first public company to hold BNB as its core asset, echoing MicroStrategy’s Bitcoin playbook. Binance founder Changpeng Zhao (CZ) acknowledged the news, clarifying that Binance isn’t behind it, but expressed full support. He even joked, “BNB ‘MicroStrategy’ coming to a company near you!”

The strategy of turning crypto into balance sheet assets is expanding. MicroStrategy, which now holds over 592,000 BTC, paved the way. Now, firms like Tether, SoftBank, and even Trump’s Truth Social are building reserves in various tokens. Others like SharpLink Gaming and Upexi are betting on Ethereum and Solana.

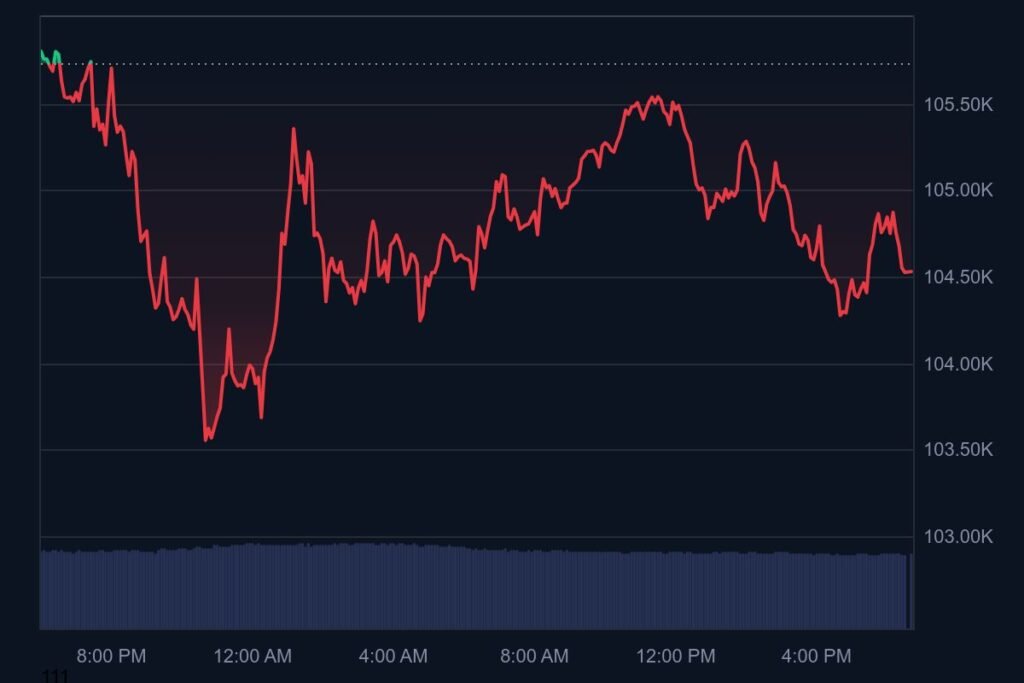

BNB, launched in 2017, remains one of the most recognized crypto assets, with a clean regulatory profile compared to other tokens. Despite Binance’s legal challenges in 2023, crypto sentiment in the U.S. has shifted more positively since, especially under former President Trump. The SEC officially ended its lawsuit against Binance in May 2025.

With ETF buzz swirling around XRP and BNB, this corporate move could be the start of something much bigger.

You might also like: Cointelegraph Hack: $Millions at Risk After Fake Airdrop Scam Hits Homepage