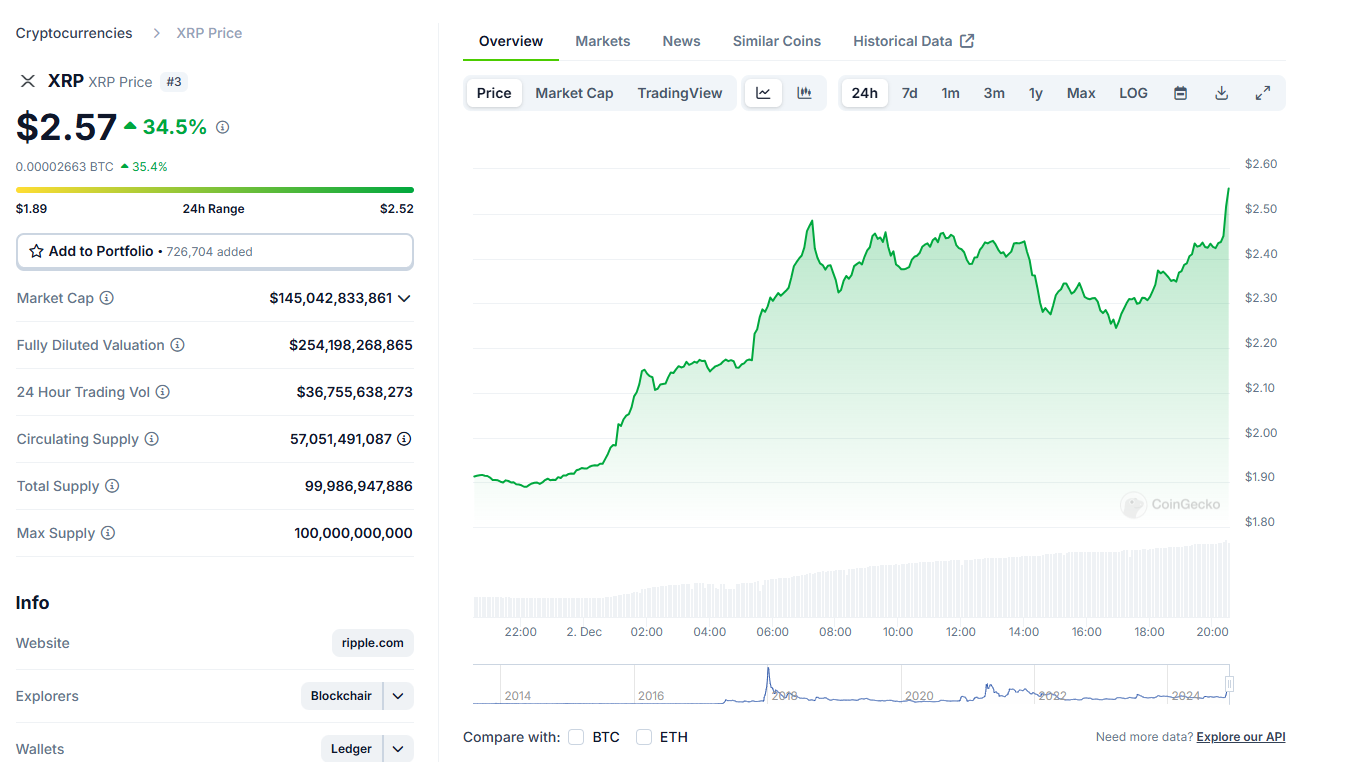

Summary: XRP is shining really bright in South Korea, with trading volumes smashing past Bitcoin and Dogecoin. On platforms like UpBit and Bithumb, XRP hit $800M in a day, becoming the country’s crypto MVP.

XRP’s Jaw-Dropping Surge

South Korean traders are all-in on XRP, with daily volumes crossing a mind-blowing $800M across major exchanges. UpBit alone handled $600M, while Bithumb chipped in with $200M. For context, Bitcoin barely hit half of XRP’s numbers, and tokens like Dogecoin and Ethereum barely registered a blip. XRP’s wild run is turning heads, signaling some serious FOMO brewing in the market.

YOU MIGHT ALSO LIKE: Vitalik Buterin Drops 50 ETH to Back Tornado Cash Dev Alexey Pertsev

South Korea’s Love Affair with XRP

Known for their high-risk, high-reward trading style, Korean investors are hyped about XRP, often fueling dramatic price moves. High volumes like these are more than just stats they’re like a flashing “Get Ready” sign for big action. Whether it’s a moonshot rally or a gut-punch correction, the market’s vibes suggest XRP could be gearing up for something massive.

YOU MIGHT ALSO LIKE: Zerebro AI Memecoin Hits $700M Market Cap Milestone

The Token to Watch

XRP isn’t just another coin in South Korea it’s the star of the show. With local traders reacting to every market and political ripple, XRP is dominating the charts and keeping the community glued to the action.