Crypto Hackers Just Made It Stupid Easy to Steal $1.6B — Welcome to the Era of $100 “Drainers”

If you thought crypto scams were wild before, buckle up. The new villain in the Web3 streets? Drainer-as-a-Service (DaaS) — basically malware-as-a-subscription for crypto thieves. And get this: it starts at just $100.

Yep. For the price of a decent dinner, you too could (illegally) drain wallets. According to AMLBot’s April 22 report, drainer kits are now plug-and-play for criminals, no dev skills needed. All you need is a Telegram login and bad intentions.

Cybercrime Now Has a Help Desk

Phishing forums? Poppin’.

Darknet chats? Recruiting devs.

Telegram groups? Handing out tutorials like it’s a Web3 Udemy.

Some of these drainer gangs are so bold they’re setting up booths at crypto events like they’re legit startups. One crew, CryptoGrab, is a textbook case — operating freely thanks to loose enforcement in countries like Russia, where local laws turn a blind eye unless you scam their own.

And yeah, malware often auto-deactivates if it detects a Russian device. Homeland protection mode: activated 🇷🇺.

$494M Stolen via Drainers in 2024

That’s up 67% from 2023.

Kaspersky says darknet drainer forums more than doubled (55 ➡️ 129) between 2022 and 2024.

Telegram’s increasing data sharing has pushed them back to the Tor network, where it’s dark mode forever.

Q1 2025: Crypto’s Bloodiest Quarter Yet

Let’s talk numbers that hurt:

In just the first 3 months of 2025, total hacks torched $1.63 BILLION across 39 incidents.

That’s 4.7x more than the same time last year.

The top two gut punches?

- Phemex: $69.1M drained in Jan

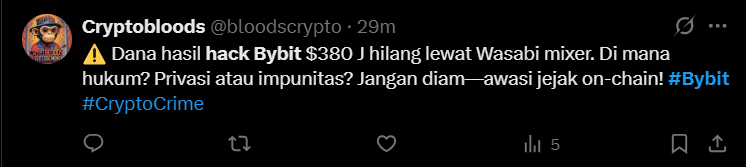

- Bybit: $1.46B gone in Feb (yep, that’s billion with a B)

North Korea’s Lazarus Group is suspected to be behind most of it—94% of the total Q1 damage. That’s $1.52B stolen. Savage.

TL;DR

However, security isn’t broken — it’s basically non-existent right now.

And with drainers going for $100 a pop, expect even more losses if the space doesn’t level up its defense game ASAP.

You might also like: Bitcoin ETFs Score Huge $381M Inflows — Bullish Momentum Returns as BTC Blasts Past $90K