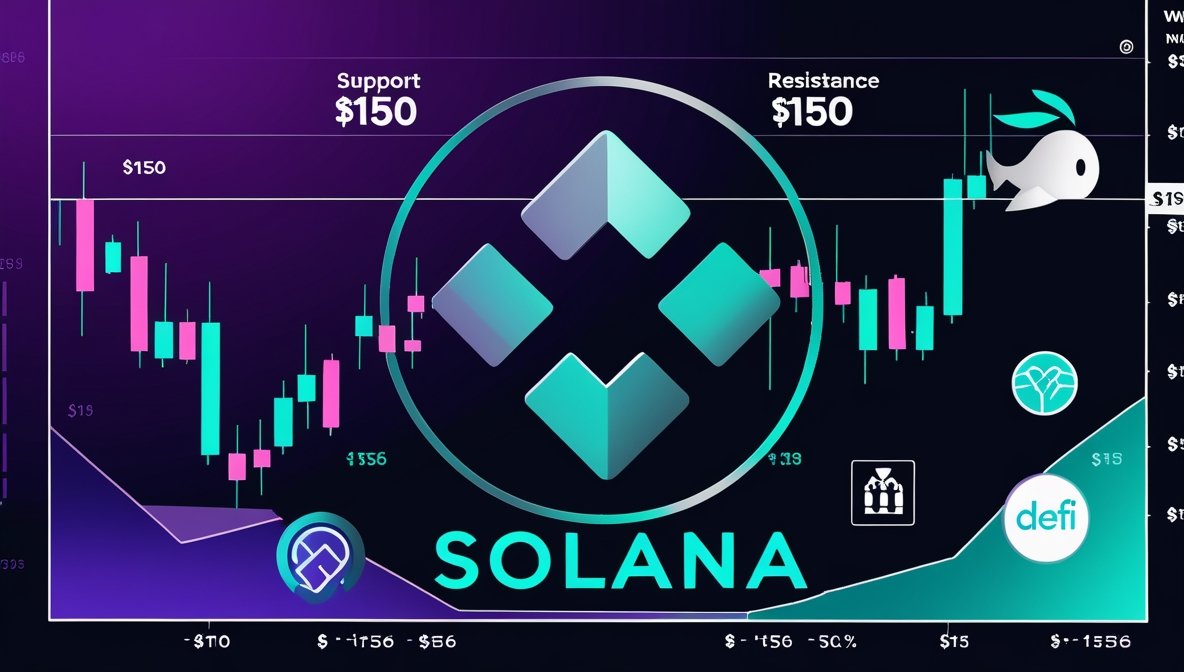

The focus today for Solana price today is how SOL is moving within a tight range just below $155, backed by stronger network activity and whale behavior. Here are four signals that could determine if SOL breaks higher—or pulls back.

4 Solana Price Today Signals You Need to Know

- Support Holding Strong at ~$150

SOL has bounced off the $150 level twice in the past 24 hours, showing buyers are stepping in to defend this key zone—a positive setup for bulls. - Resistance at $156–$158

SOL continues to test overhead resistance between $156–$158. A decisive breakout here on strong volume could pave the way to the next target at $165. - Whale Accumulation Off-Exchanges

Large holders have moved roughly $30 million worth of SOL from exchanges into staking/long-term wallets, signaling reduced sell pressure and rising convictions. - DeFi Growth & TVL Uptick

Solana’s DeFi ecosystem is showing signs of resurgence, with TVL up ~7% this week. Increased user activity in lending, AMM protocols, and NFTs adds bullish tailwinds.

Quick Take:

Solana price today is consolidating near $150–$158. With solid support, growing on-chain activity, and whale accumulation creating favorable conditions, a breakout is possible. But traders should watch for a volume-backed move above $158 to confirm momentum. Otherwise, SOL may revisit $150—or dip slightly lower. Track DeFi metrics and wallet flows to gauge next direction.

YOU MIGHT ALSO LIKE: Kraken Launches Krak: New Global P2P App to Rival PayPal and Cash App