Chainlink (LINK) is showing signs of renewed bullish momentum after bouncing from the $17 support zone. The altcoin has surged to $18.53, gaining over 3% in the past 24 hours, with trading volume exceeding $911 million. This uptick signals growing investor confidence as LINK eyes a potential breakout.

Currently testing resistance between $19 and $21, LINK appears ready for a move higher. Technical indicators support this outlook — the price is hugging the upper Bollinger Band, and RSI is holding strong around 67 after cooling slightly from the overbought zone at 72.95. A decisive close above $19 could send LINK soaring toward the $21–$23 range.

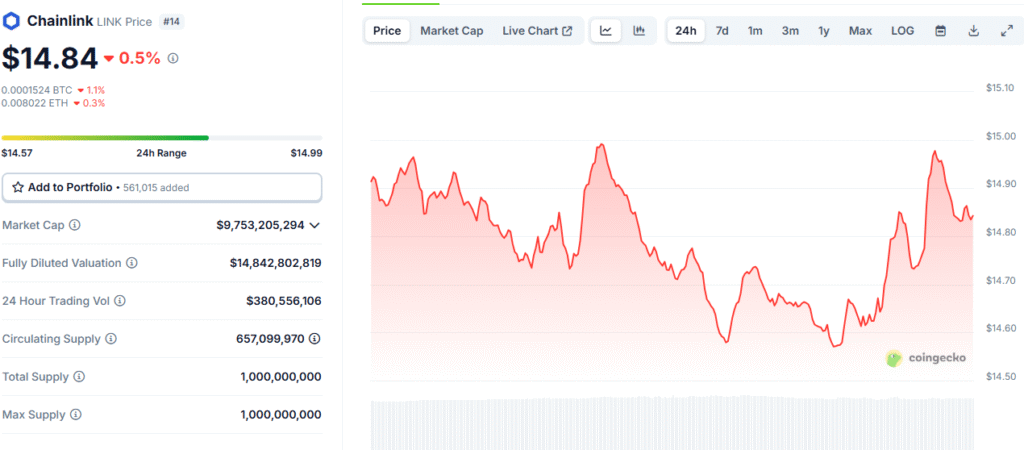

With a market cap of $12.5 billion, Chainlink ranks 14th in the crypto market, reflecting its solid community and use-case strength. However, if LINK fails to clear the $19 barrier, it risks a short-term correction back to $17 or even $15, aligning with the Bollinger midline and 20-day SMA.

As the altcoin market turns green, Chainlink is one to watch closely. A breakout from this zone could signal the next phase of the rally.

You might also like: Ripple Co-Founder Moves $175M in XRP, Triggers Market Selloff Speculation