Three months after one of the largest crypto heists in history, nearly $644 million of the $1.4 billion stolen from Bybit has vanished from traceable blockchain records, according to new data.

Blockchain analysis shows that about 49.5% of the funds remain traceable, while only 4.5% ($63 million) has been frozen by exchanges and law enforcement. The majority of the stolen funds have been processed through sophisticated cryptocurrency mixing services designed to obscure transaction trails.

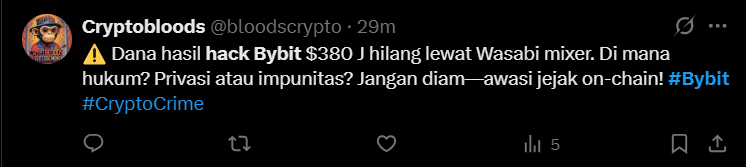

The largest portion — $247.5 million in Bitcoin (966 BTC) — was funneled through Wasabi Wallet, a privacy-focused tool. Another $94.1 million was laundered through eXch, a mixing service that falsely claimed to shut down in April, but continues to operate via private back-end APIs, according to TRM Labs. The bybit hacks however keep getting out of hand.

Other privacy tools used include:

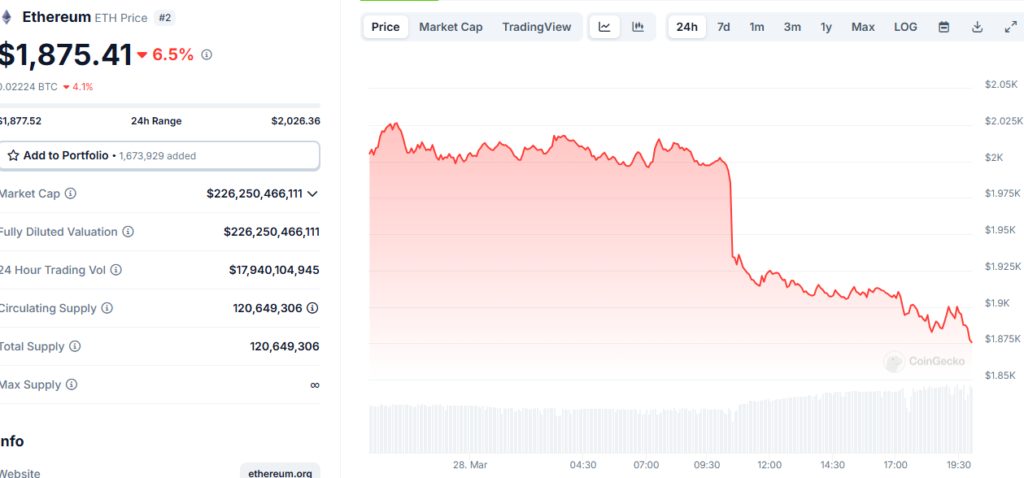

- Tornado Cash: $2.5M in ETH

- Railgun: $1.7M in ETH

These services obscure transactions by pooling user funds, making it nearly impossible to trace where the crypto ends up.

The attack’s origin was equally concerning. A report by Safe Wallet revealed that the North Korean hacker group TraderTraitor gained access to Bybit funds by compromising a developer’s laptop. Disguised as a stock trading simulator, a malicious Docker project led to the installation of malware, which stole AWS session tokens and bypassed multi-factor authentication.

Despite initial containment efforts, the incident reveals critical vulnerabilities in Web3 security hygiene, and highlights the ongoing challenges of crypto asset recovery once funds enter opaque mixing systems.

You might also like: AIXBT Price Eyes $0.50 After 25% Rebound and Surge in Trading Volume