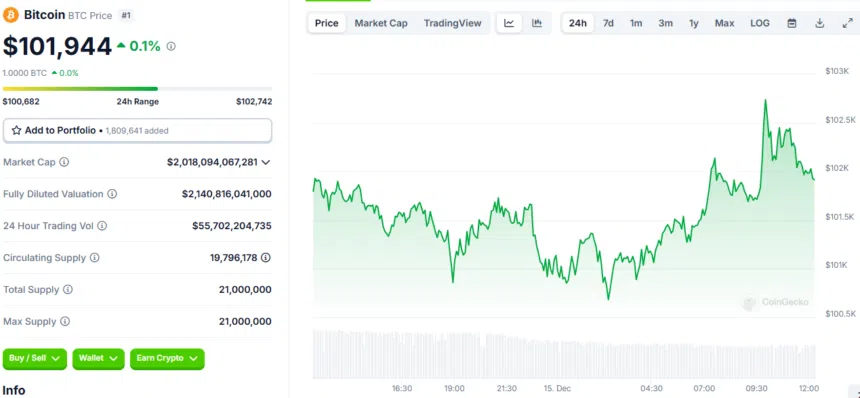

Summary: Bitcoin just broke another one of its own record and broke $105K and just hit an all-time high of $106,488, thanks to a Trump-fueled crypto hype train. The former U.S. president’s plans to create a “Bitcoin reserve” have crypto investors buzzing, pushing BTC to insane new levels.

Trump’s Crypto Love Sparks FOMO Frenzy

Bitcoin’s record-breaking rally kicked off after Donald Trump dropped the mic at the New York Stock Exchange, announcing his intention to make Bitcoin part of America’s strategic reserve. “We’re gonna do something great with crypto… we want to be ahead,” Trump said, sending Wall Street and retail investors into a frenzy. Add in the BITCOIN Act from Senator Cynthia Lummis, proposing the U.S. buy 1 million BTC to tackle debt, and you’ve got FOMO hitting peak levels.

YOU MIGHT ALSO LIKE: $27 to $52M?! PEPE Investor’s Wild Ride

Global Bitcoin Rush Heats Up

It’s not just the U.S. making moves. Russia’s jumping on the Bitcoin bandwagon too, with President Putin calling BTC unstoppable and a solution to sanctions. Russian Finance Minister Anton Tkachev even floated the idea of a Bitcoin reserve. Meanwhile, MicroStrategy flexed hard by dropping $2.1 billion on 21,550 BTC, bumping their stash to 423,650 coins—biggest corporate holder flex, period.

Bitcoin Miners Crushing It

On the tech side, Bitcoin’s hashrate is off the charts, climbing to 804 EH/s this year—an insane leap from 128 EH/s. Miners have raked in $71.5 billion so far, proving BTC isn’t just hype, it’s a powerhouse.

YOU MIGHT ALSO LIKE: Is Cutoshi the Next Shiba Inu? Meme Coins Leveling Up

Crypto’s never been this lit. Are you riding the wave or watching from the sidelines?