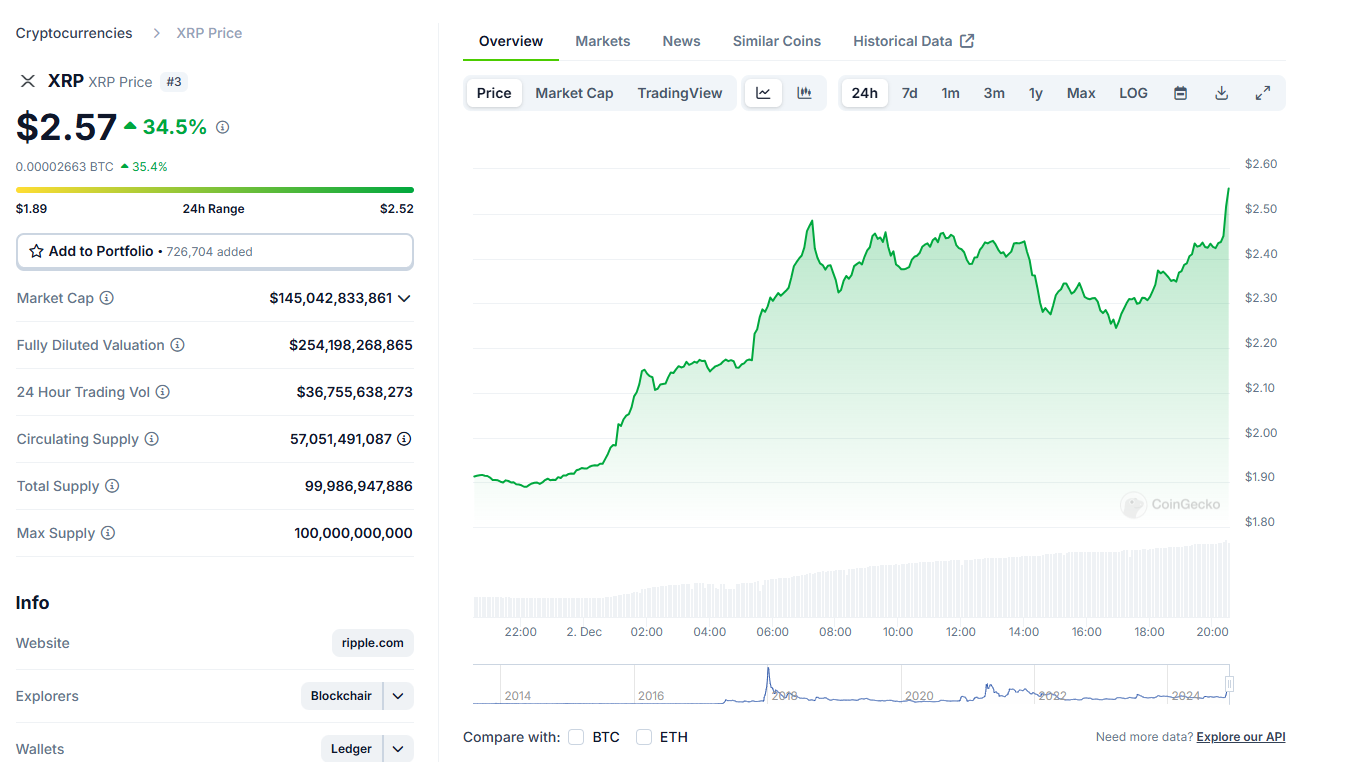

XRP just leveled up on its game after overtaking Solana and USDT to become the 3rd biggest crypto. Its price spiked 30% in just a day and hit a massive $2.5, with a insane 370% jump from previous months . Ripple’s stablecoin RLUSD approval buzz and SEC drama are fueling the hype.

XRP is having its main character moment, y’all. The altcoin just flexed big time, climbing over Solana (SOL) and USDT to snatch the #3 spot in the crypto market. Right now, only Bitcoin and Ethereum are ahead of it, but the way XRP is moving, people are starting to wonder if this is just the beginning.

Here’s the tea: XRP hit $2.5 recently, spiking over 30% in just 24 hours. It’s now trading around $2.41, and that’s after a massive 370% gain since November 1. If you’re wondering why everyone’s losing their minds over it, one reason is Ripple’s new stablecoin, RLUSD. The New York regulators are apparently ready to approve it, which is a big deal because NY has some of the toughest rules in the crypto game. If RLUSD gets the green light, Ripple can step into the big leagues with stablecoin giants like Tether (USDT) and Circle’s USDC.

But wait, there’s more! SEC Chair Gary Gensler just announced he’s dipping out in January, and that news has been giving XRP even more of a boost. People are also buzzing about potential XRP ETFs, with major players like 21Shares and Bitwise lining up to get in on the action.