Summary [ Gen-Z ]:

The Fed cut rates, making money cheaper, and it's flowing into crypto. Last week alone, $321M came in, with Bitcoin taking the lead while ETH, BNB, and ADA were in the red. Interestingly, $5.1M was used to bet against Bitcoin (Short Bitcoin).

With the Fed's 50 bps rate cut, more cash might hit the market, but it's also a red flag that the economy needs a boost to stay afloat.With the decision of Fed rate cut, new money is flowing into crypto. Last week’s inflow hit a record of $321 million.

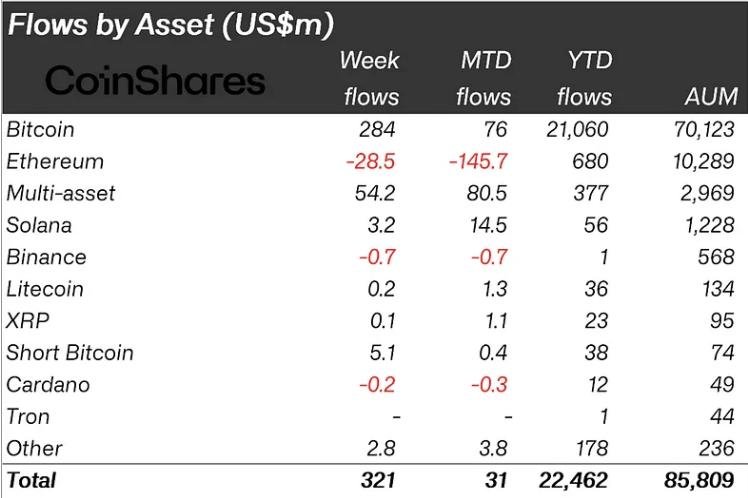

Based on data released by CoinShares, Bitcoin led the inflow of money while Ethereum, BNB, and Cardano remained negative. Meanwhile, $5.1m inflow went for “Short Bitcoin”.

After the decision of 50 bps rate cut by the Fed, the impacts can be deeper. Cheaper money might enter the market but this also signals a weaker economy that needs artificial boosting.

If you liked this article, please subscribe to our YouTube Channel for web3 video tutorials. You can also find us on Twitter and Instagram.