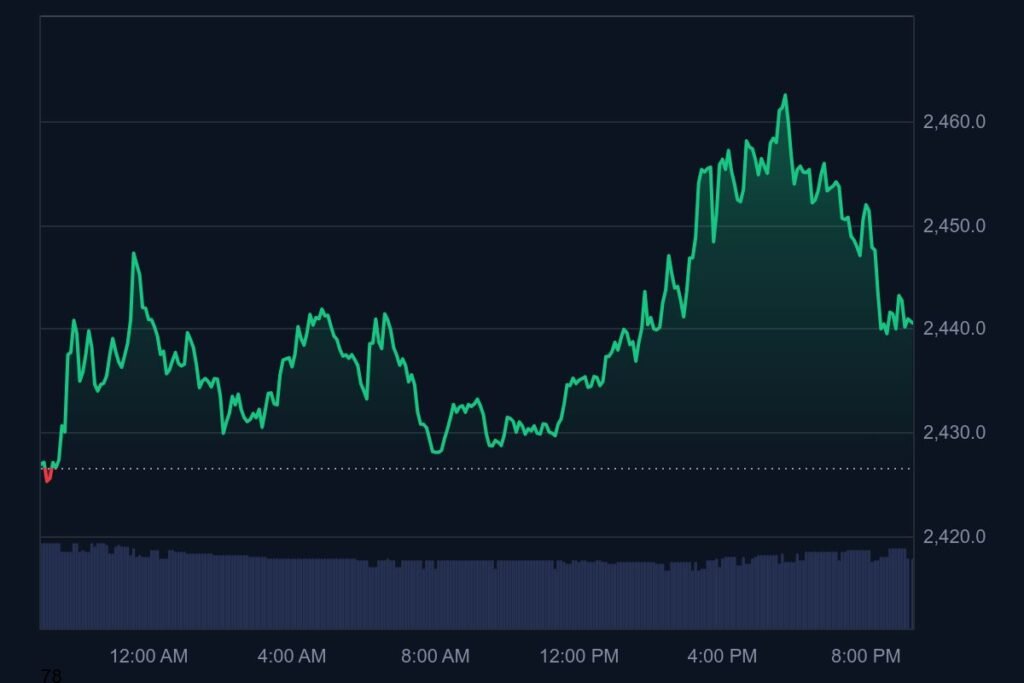

After dipping to $126, solana bounced back hard and now trades at $147.12—up 4.3% this week. 📈 The real kicker? It just broke above a tight triangle pattern and flashed a golden cross. Bulls are back in control, fam.

💡 Key signals saying SOL might pop off:

- Broke above $144 triangle resistance

- Golden Cross (9MA > 21MA)

- MACD green + EMA trending up

- Binance long positions rising = traders betting big

If SOL stays strong above $147.50, we could see targets at $150.54, $154.43, and even $158.81. And if volume picks up? Analysts say $172.51 might be in play midterm. That’s a 17% pump. 🚀

Trade Setup 🧠:

- Entry: Buy above $147.50 (only if strong volume)

- TP1: $150.54

- TP2: $154.43

- SL: Below $144.00

- Pullback entry: $144–$145 if it confirms support again

Meanwhile in presale land…

Bitcoin Hyper ($HYPER) is cooking 👀🔥

It just crossed $1.67M in its presale, closing in fast on the $1.9M cap. It’s not just another meme coin though. $HYPER is the first Bitcoin-native Layer 2 built with Solana’s tech (SVM).

That means:

⚡ Fast.

💸 Cheap.

🧱 Built on BTC’s security.

Plus, 91M tokens already staked and estimated 577% APY rewards after launch. Gas fees, dApps, and governance—all powered by $HYPER. No wallet? No problem. You can buy with just a card. 📲

Presale ends soon and the price is about to jump from $0.01205. Catch it before the tier flips. This could be 2025’s Layer 2 dark horse.

You might also like: Kraken Launches Krak: New Global P2P App to Rival PayPal and Cash App