PENGU, the native token of the Pudgy Penguins ecosystem, soared over 25% in the last 24 hours, hitting $0.01849, amid two landmark developments—a new ETF filing and the announcement of a Web3 mobile game.

A First-Ever PENGU NFT ETF?

On July 10, the U.S. Securities and Exchange Commission (SEC) officially acknowledged a spot ETF filing by Canary Capital Group for the Canary Spot PENGU ETF. If approved, it would be the first U.S. exchange-traded fund combining a memecoin and NFT exposure.

The proposed ETF will allocate:

- Up to 95% tokens

- A portion to Pudgy Penguins NFTs

- Minor allocations in Solana and Ethereum for liquidity

This gives traditional market investors exposure to Web3-native assets without needing to directly hold crypto or NFTs. Additionally, the fund will actively manage NFT holdings based on rarity and visual traits, making it one of the most dynamic crypto ETFs ever proposed.

Although a listing venue hasn’t been confirmed, the recognition by the SEC already marks a regulatory milestone for memecoins and NFT-linked tokens.

🎮 Pudgy Party Game Launch: The Next Web3 Hit?

Adding fuel to the fire, Pudgy announced the upcoming launch of Pudgy Party, a mobile game built in collaboration with Mythical Games. The game will launch in August 2025 on the Mythos Chain—a Polkadot-based network that previously powered NFL Rivals, which has surpassed 6 million downloads.

The game will feature:

- Casual party-style gameplay

- Playable NFT avatars

- On-chain rewards and leaderboard incentives

This positions Pudgy Party as a potential mainstream entry point for gamers into Web3, leveraging the IP’s massive brand appeal and blockchain infrastructure.

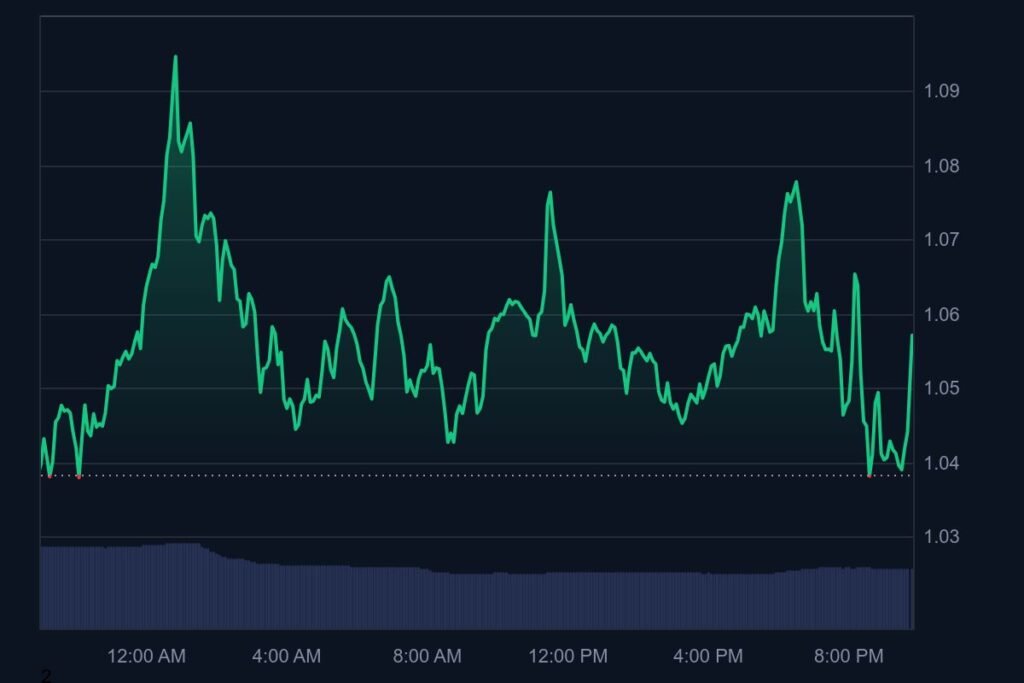

PENGU Price Reaction and Market Impact

Following the dual announcement:

- PENGU price jumped to $0.01849

- 24h trading volume rose 138% to surpass $486 million

- Market cap crossed $1.16 billion

If the ETF is approved, token could become the first memecoin in a regulated financial product, signaling a significant leap for the integration of NFTs and meme assets into traditional finance.

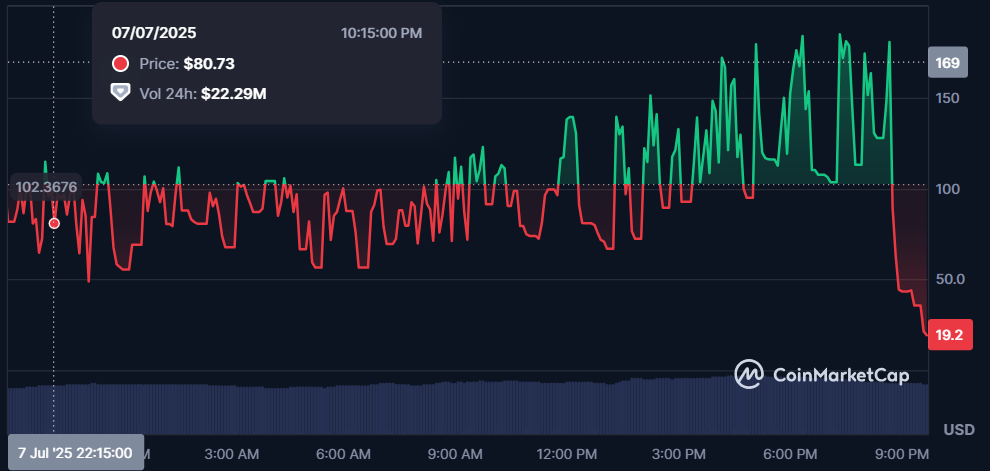

You might also like: Fartcoin Falls 8% in Sharpest Daily Drop in Weeks, Market Cap Slips Below $1.1B