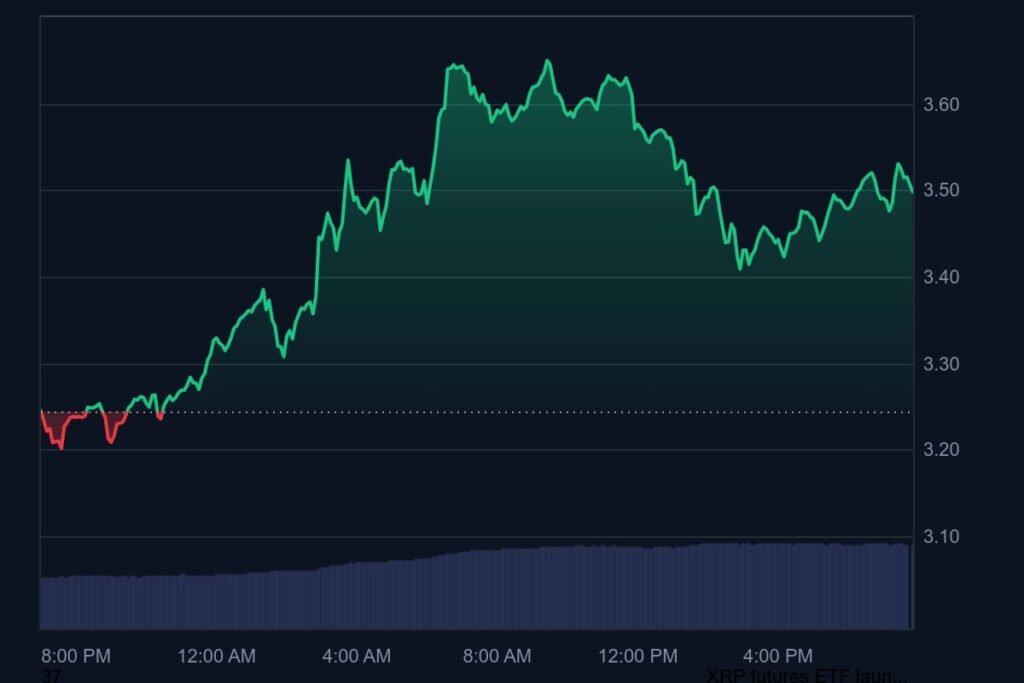

XRP has surged 25% this week, boosted by excitement around the upcoming launch of the ProShares Ultra XRP ETF (UXRP) on the New York Stock Exchange. Scheduled for July 18, this ETF will offer leveraged exposure to XRP via futures and options, not direct spot holdings. While a true spot ETF remains unapproved, its launch could drive significant trading volume and further strengthen bullish sentiment.

Currently, it is testing the critical $3 resistance level, a key psychological and technical barrier. Popular crypto analyst Ali Martinez predicts that if it breaks past $3 decisively, the price could target $4.80 in the near term. Trading volumes are rising as the token attempts to break out.

However, a retest of $2.65 may occur before a sustained rally. If bulls gain momentum during the U.S. trading session, XRP could push toward the $4 level soon.

Meanwhile, early-stage project SUBBD (SUBBD) is attracting investor attention, raising nearly $1 million in presale. SUBBD aims to revolutionize content sharing for influencers, giving creators control over monetization and platform governance via its $SUBBD token. With over 2,000 creators onboard, SUBBD could see explosive growth once it launches officially.

You might also like: Cardano (ADA) Blasts 30% Weekly as Alt Season Heats Up—Is $2 Next?