Michael Saylor’s Strategy Buys $739M in Bitcoin, Total Holdings Cross 607,000 BTC

Michael Saylor is doubling down on Bitcoin once again. Strategy, the largest corporate holder of Bitcoin, has purchased another 6,220 BTC for $739.8 million, bringing its total holdings to a massive 607,770 BTC, according to an official announcement released today.

Strategy Acquires More BTC Amid Market Stability

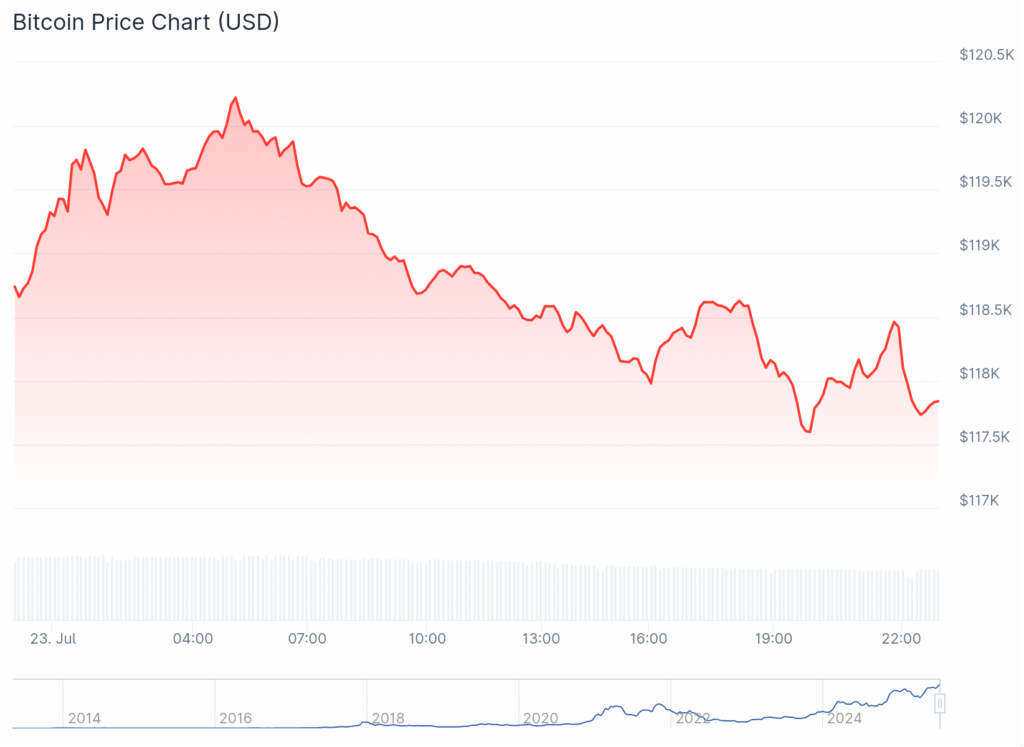

The purchase, made between July 14 and July 20, was executed at an average price of $118,940 per Bitcoin. The firm utilized funds raised via at-the-market (ATM) offerings of its MSTR Class A shares and related instruments—STRK, STRF, and STRD.

Michael Saylor took to X (formerly Twitter) to share the milestone, stating that Strategy’s year-to-date BTC yield stands at 20.8%. The company’s total BTC acquisition cost now stands at $43.61 billion, with the average buy-in price across all purchases at $71,756.

“Strategy now holds 607,770 BTC, valued at $71.93B—nearly $28.3B in unrealized gains,” shared Saylor.

Recent Buys Signal Aggressive Accumulation Strategy

This purchase follows last week’s buy of 4,225 BTC for $472.5 million. With the latest additions, Strategy’s Bitcoin portfolio is far ahead of any other public or private entity globally.

Analysts view this as continued conviction from Saylor that Bitcoin remains the best treasury reserve asset, especially as macroeconomic conditions stabilize and institutional inflows strengthen.

MSTR Stock Reacts Positively

Shares of MSTR jumped 2% in premarket trading, reaching $431.95, partially reversing Friday’s 6.23% dip. Over the past month, the stock is up 15% and has climbed 46% year-to-date.

Investment bank TD Cowen recently raised its price target for MSTR from $590 to $680, maintaining a Buy rating, reflecting the company’s strong BTC-backed balance sheet and bullish investor sentiment.

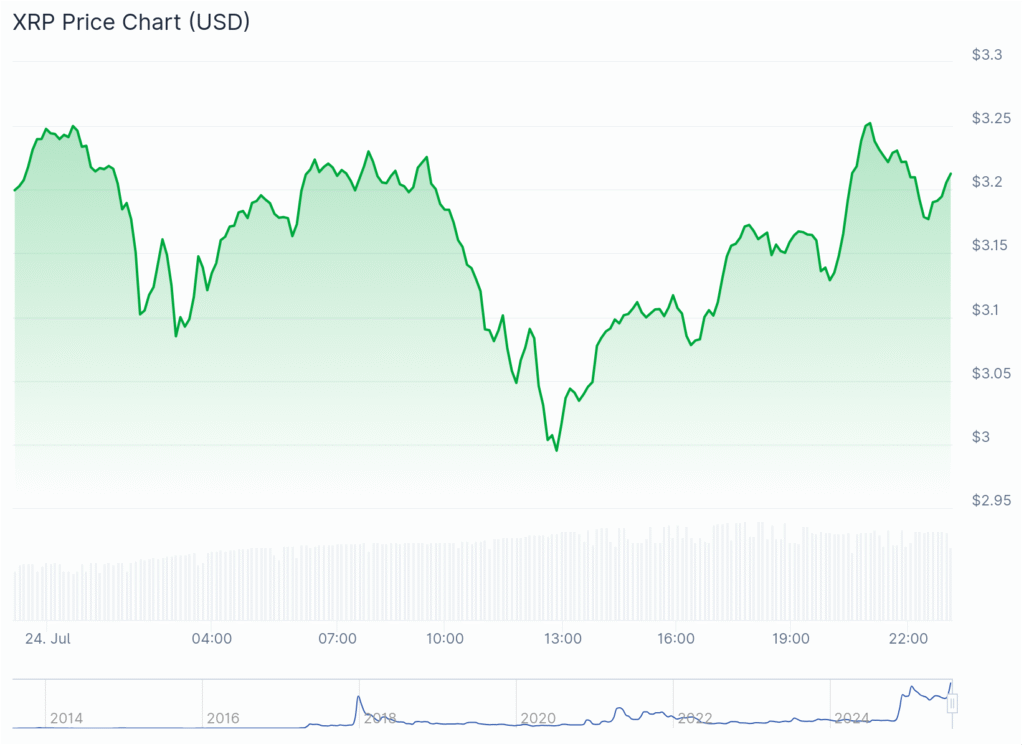

Bitcoin Price Movement

At the time of writing, Bitcoin is trading sideways, with a 24-hour low and high of $116,550 and $119,671 respectively. However, a 40% spike in trading volume in the last 24 hours suggests growing interest—partly driven by headlines like today’s Strategy purchase.

YOU MIGHT ALSO LIKE: Breaking ! Ethereum Price Analysis: 4 Key Triggers Powering ETH Toward $4K+