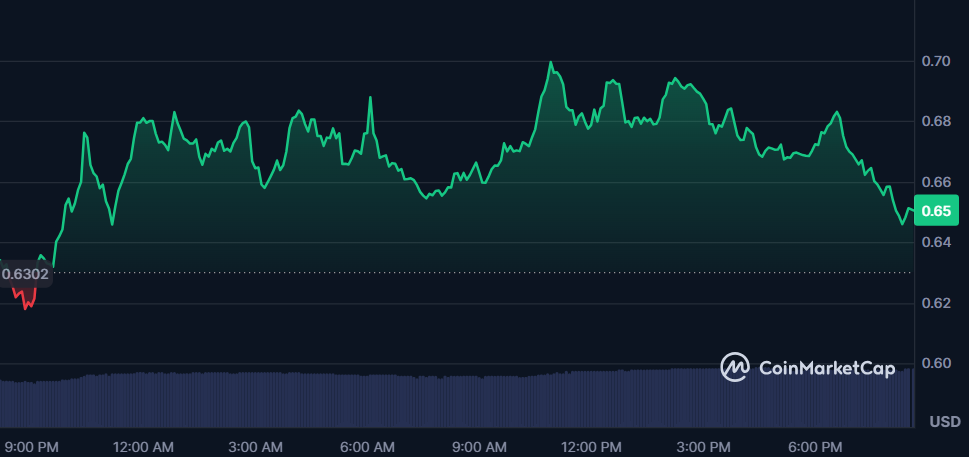

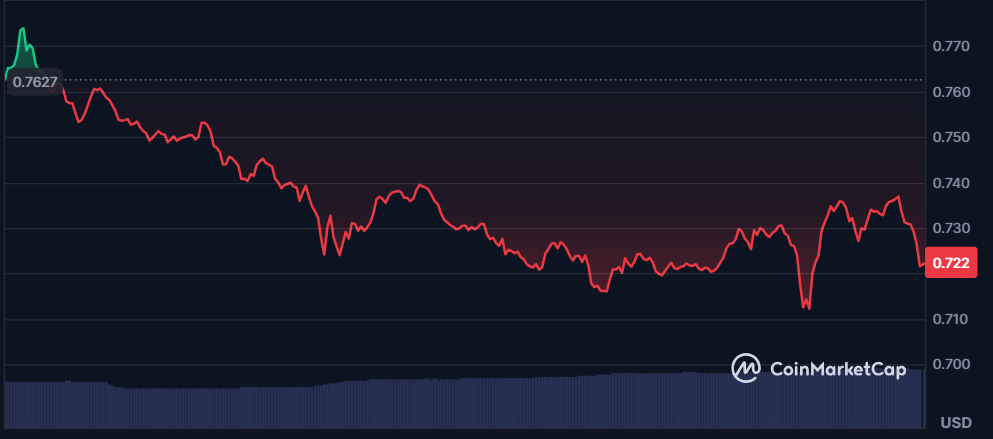

Cardano (ADA) may be entering a pivotal phase after months of sideways trading. Technical analyst Ali Martinez believes ADA’s chart is forming a setup remarkably similar to the one that preceded its 2021 rally—suggesting potential for a strong breakout.

ADA is hovering just below $0.85, right around the 0.5 Fibonacci level, which previously acted as a springboard during its last bull run. From this zone, ADA broke past $1 and surged all the way above $3.

Martinez highlights a key pattern: flat consolidation followed by a slow rise and hesitation at resistance. This quiet buildup is often a prelude to aggressive price action, especially when few are paying attention. Resistance levels to watch include $1.15, $1.74, and $3. Breaking past these opens the door for a move to the analyst’s long-term target of $6.25—backed by Fibonacci extension metrics rather than pure speculation.

Despite the bullish setup, ADA’s current momentum remains weak compared to other altcoins. For confirmation, traders should watch volume and sentiment shifts in the broader market.

Sometimes, Martinez notes, the best breakouts come from the quietest charts. ADA’s silence may be masking strength—just as it did in early 2021.

You might also like: Crypto Insane: 7 Real Events That Shook the Blockchain World Today