Qubetics ($TICS) is making serious waves in the crypto world. This innovative platform focuses on real-world asset tokenization, allowing users to digitize tangible assets like real estate, art, and commodities. With over $10.2 million raised and 430 million tokens sold, Qubetics is gaining significant traction among investors.

So, what’s fueling this meteoric rise? Here are 3 key reasons:

- Real-World Asset Tokenization: Qubetics enables the conversion of physical assets into blockchain-based tokens, democratizing access to investments traditionally reserved for the wealthy.

- Advanced Ecosystem Tools: The platform offers tools like TICSScan, an advanced transaction explorer, empowering users to track and verify every transaction, fostering trust and accountability.

- Strong Financial Projections: Analysts predict the token could reach $0.25 by the end of its presale, delivering a 630.20% ROI. With potential growth to $15 post-mainnet launch, investors could see returns exceeding 43,711.74%.

In a market flooded with fleeting trends, Qubetics stands out by combining the viral appeal of crypto with tangible real-world applications. As the crypto landscape continues to evolve, $TICS is positioning itself as a formidable player in 2025.

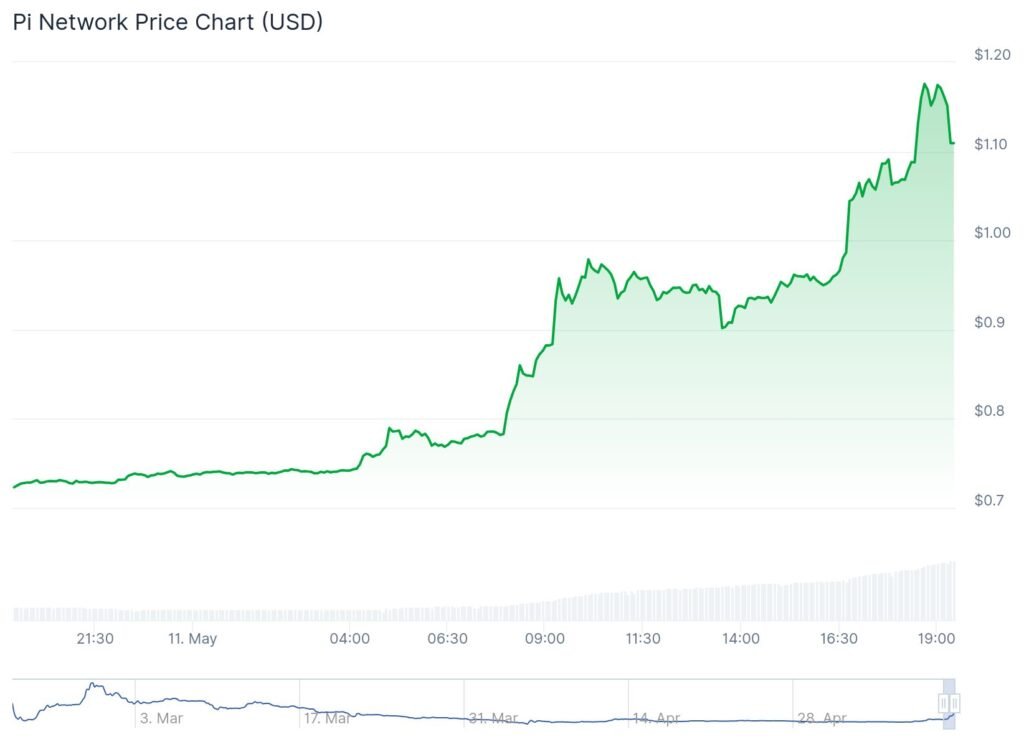

You might also enjoy: Pi Coin Jumps 30%: 3 Reasons Hype Is Exploding Ahead of May 14 Reveal