Ethereum just flexed with a 7% pump, reclaiming the crucial $2,000 level, sparking excitement across the altcoin market. But while ETH is vibing, traders are still skeptical about a possible rug pull. So, should you HODL, buy more, or secure those gains? Let’s break it down.

Big Moves from Buterin & Justin Sun

Ethereum co-founder Vitalik Buterin made waves after cashing out 71.697 ETH in a recent move that’s stirring speculation about a major shift in the crypto space. Meanwhile, Tron founder Justin Sun went all-in by staking a massive 60,000 ETH (~$114M) on Lido, securing a passive income of 1,740 ETH per year.

Adding to the hype, Ethereum’s upcoming Pectra upgrade is set to improve scalability and security, giving the ETH bulls a fresh narrative for a rally.

You might also like: TRX on Solana: 5 Key Benefits That Could Boost Crypto Liquidity

ETH Price Action – Inverted Flag Alert!

After facing bearish vibes for the past week, ETH has bounced back, forming a failed inverted flag pattern—a technical sign that could hint at continued bullish pressure.

Key Indicators:

- MACD: Green histogram gaining strength, signaling bullish momentum.

- EMA 12 & 26: Flirting with a bullish crossover on the daily chart.

- SMA: Eyeing a breakout if ETH can dodge a bear trap.

Ethereum ETF Bleeding for 10 Days Straight!

Despite ETH’s pump, Ethereum ETFs are still in the red. BlackRock’s ETHA saw a $124.6M outflow, while Grayscale’s ETHE lost $117.1M over the past 10 days.

However, if ETH sustains its bullish momentum above $2K, this trend could flip bullish, bringing fresh inflows into Ethereum-based ETFs.

Is ETH a Buy or Sell Right Now?

If bulls keep pushing, ETH could smash through $2,200 and target $2,573 soon. But if momentum dies, expect a dip back to $1,950—or even a new monthly low if bears take over.

TL;DR: If ETH holds $2K, it’s bullish. If it fumbles, brace for a drop. Trade wisely!

Check out live price on Coingecko.

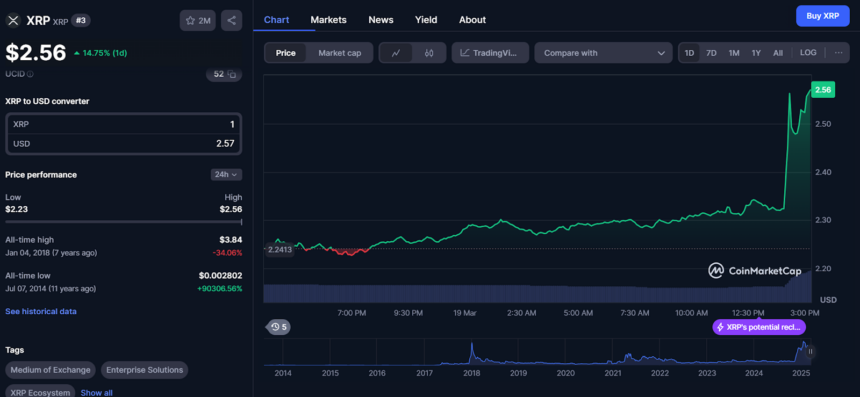

Also Read: XRP Jumps 14% as SEC Drops Ripple Lawsuit After 4 Years