SEC Lawsuit Finally Over

Ripple CEO Brad Garlinghouse has announced a major shift back toward the U.S. market after winning the company’s legal battle against the Securities and Exchange Commission (SEC).

Previously, 95% of Ripple’s customers were outside the U.S., but now, the company believes it can strengthen its position at home.

A Long Legal Battle Ends

The SEC sued Ripple in December 2020, claiming XRP was an unregistered security. After years of legal fights, Ripple has officially settled the case. The SEC dropped its lawsuit, agreed to a $50 million fine, and withdrew its appeal.

With this victory, it can now sell XRP to institutional investors without any restrictions, which Garlinghouse called a huge win for the entire crypto industry.

Ripple’s Renewed U.S. Focus

Even during legal troubles, it continued expanding internationally. But now, with the lawsuit behind it, the company is refocusing on the U.S., where many businesses had hesitated due to regulatory uncertainty.

The crypto regulatory environment in the U.S. is changing, with Donald Trump’s administration pushing pro-digital asset policies. Trump recently launched a Crypto Advisory Council, and rumors suggest that Garlinghouse may play a role.

Challenges Still Remain

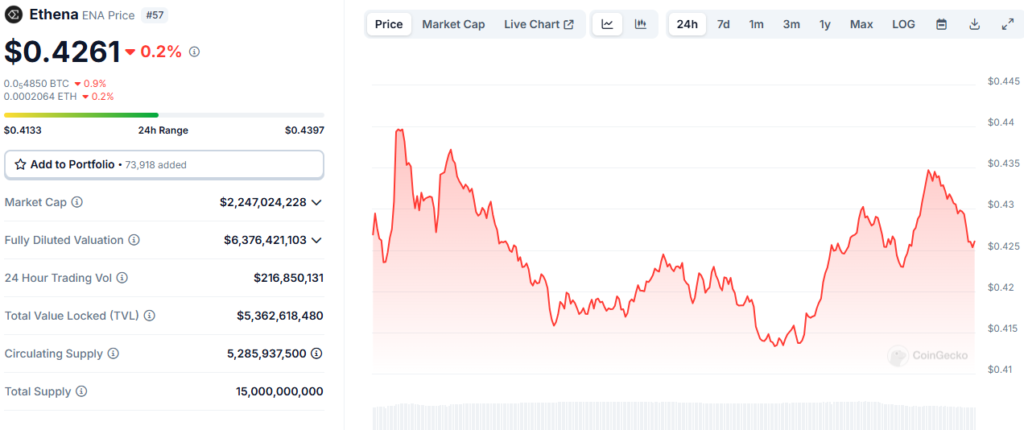

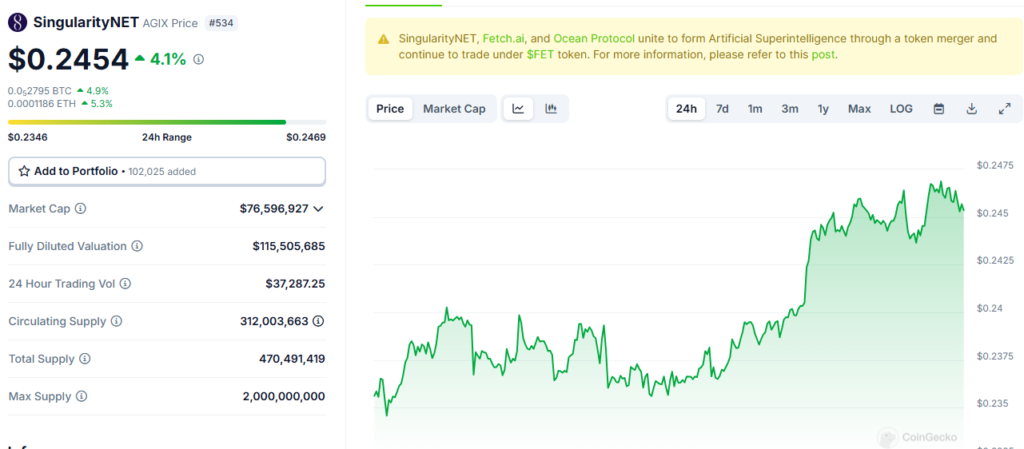

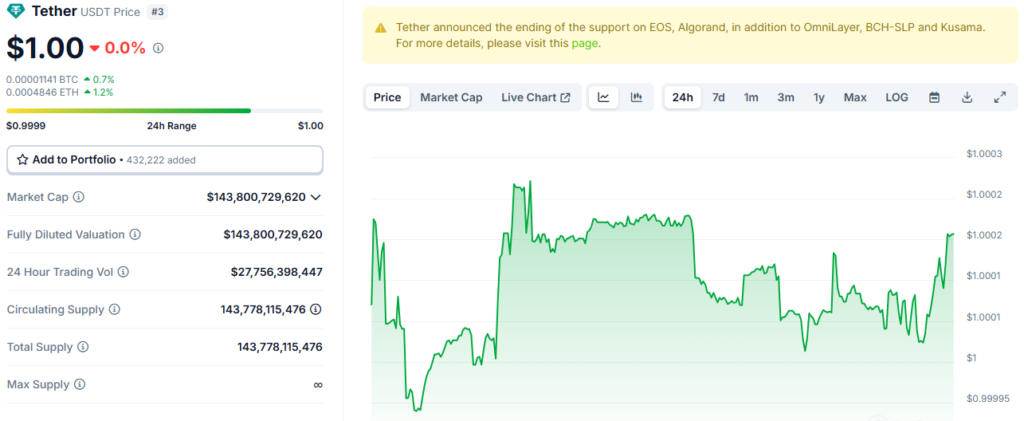

Despite its legal win, it faces tough competition. The crypto payments market is dominated by stablecoins like USDT and USDC, so Ripple must prove its tech is valuable to U.S. businesses.

Additionally, crypto regulations in the U.S. remain unclear. It must navigate these complexities while competing with other blockchain-based payment solutions.

Looking Ahead

With the SEC battle behind it and regulatory shifts in its favor, Ripple sees massive potential in the U.S. market. The company plans to use its technology, partnerships, and reputation to make XRP a key player in American finance.

Garlinghouse emphasized that Ripple never wanted this legal fight, but had to stand its ground. Now, with victory secured, the company is ready to move forward and establish itself as a major force in the U.S. crypto space.

You might also like: Google Play Blocks 17 Crypto Exchanges in South Korea Causing Havoc