DogeCoin just woke up

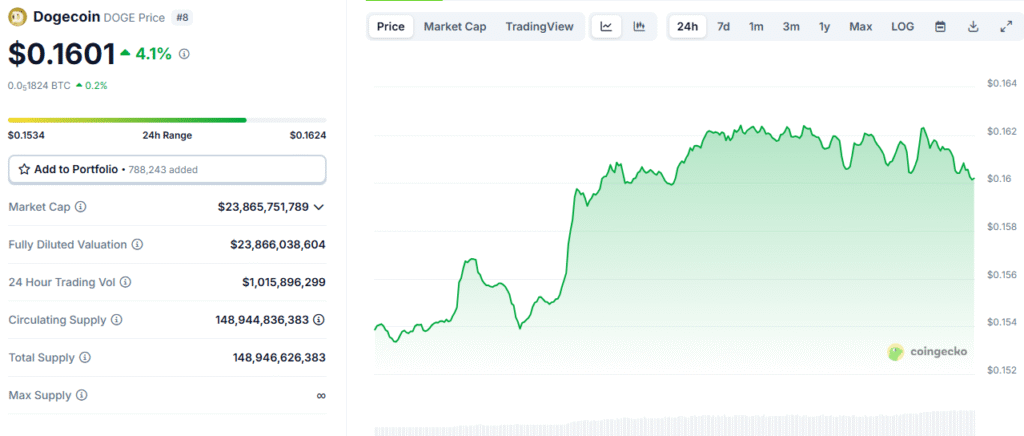

Right after its unofficial holiday—DOGE Day (April 20)—the OG memecoin pulled a total glow-up, smashing through the $0.16 resistance wall for the first time in months. Yup, the internet’s fave Shiba Inu is back in action, and this time it’s not just meme magic—it’s backed by real moves and market heat.

We’re talking actual bullish signals here, not just Elon tweets and Reddit threads. So what went down? Let’s dive in

Breaking Out of the Downtrend Dungeon

For the longest time, DOGE was stuck in a descending channel—aka a crypto chokehold where the price kept dipping into lower highs and lower lows. But on DOGE Day, the price said “nah” and broke clean outta that bearish spiral. This type of breakout is usually the first step in a major trend reversal, and it hit just when everyone had nearly written it off.

But wait, it wasn’t just vibes—it was validated by data.

Indicators Are Screaming “Bullish!”

Money Flow Index (MFI) surged to 71.71, meaning big money is flowing back in. The higher that number, the more demand is heating up. And right now, it is looking thicc with interest.

Trading Volume? Oh, it went off.

On the morning of DOGE Day, we were chilling at under $500M. By the time the bulls stampeded in, volume hit $867M. That’s a spicy 63% jump—and that kind of surge doesn’t happen unless there’s real buying pressure behind it.

Parabolic SAR flipped bullish, now sitting below the price = support incoming.

Awesome Oscillator turned green = momentum shift confirmed.

All signs point to a legit move, not a pump-and-dump.

What the Analysts Are Saying

Crypto guru Rekt Capital chimed in with some bullish tea:

“If sellers are out of the picture and buyers keep stepping in, DOGE has room to run.”

Translation? As long as the sell pressure stays low and buyers keep stacking, $0.18 is totally in reach. And if the broader crypto market joins the party (which it might—ETH and BTC are also flexing), $0.25 could be the next big milestone.

But it ain’t all sunshine and memes—momentum can fade fast. If buyers lose steam, DOGE might slide back to $0.10 support, which could spook short-term holders. So yeah, bullish… but watch your step.

Current Stats? Lookin’ Fresh

- Price: $0.1608

- 24hr Change: +5%

- Market Cap: Just under $24B

- Ranking: Still chillin’ in the Top 10 Cryptos

DOGE isn’t just a joke coin anymore—it’s proving once again that meme power + real technical breakouts = a force to watch.

So, What Now?

If you’re already holding DOGE, it might be time to hodl tight and ride the wave. If you’re thinking of getting in, don’t just FOMO—watch the charts, track volume, and wait for those confirmation signals.

The next few days will be crucial. Either DOGE locks in a new uptrend… or slips back into the meme abyss. Whatever happens, one thing’s clear: DOGE isn’t done yet.

You might also like: Michael Saylor Acquires Awesome 6,556 More Bitcoins, Total Holdings Soar to 538,200 BTC