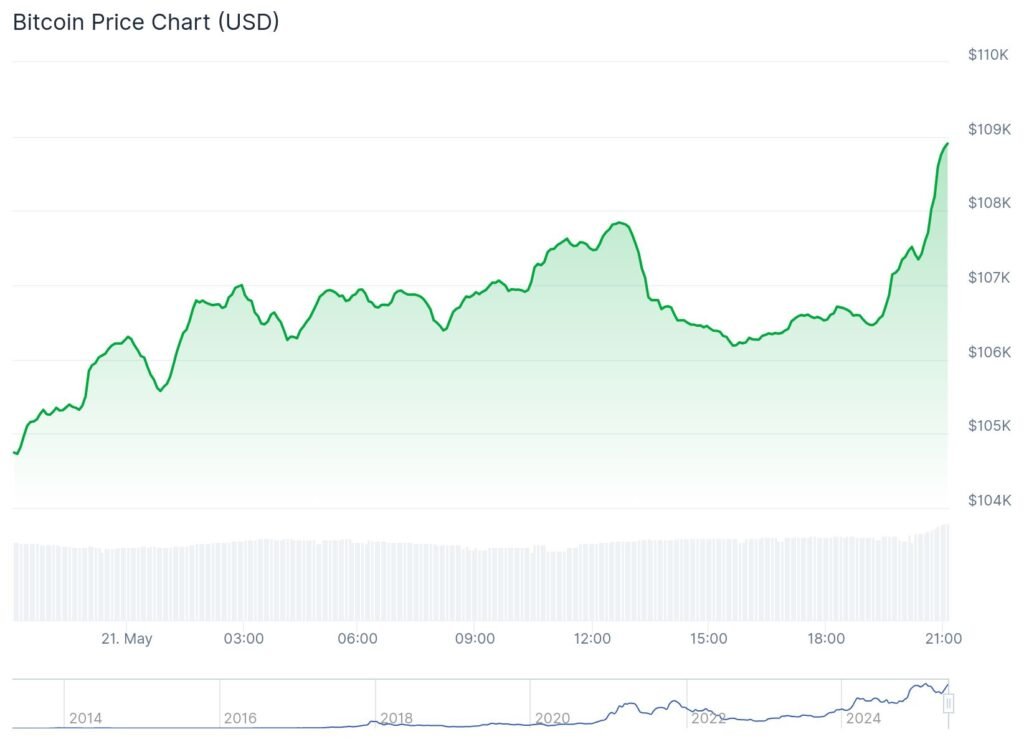

Bitcoin’s smashing new ATH at $109,114.88 isn’t just numbers—it’s pure vibes. What’s fueling the rocket? Chill trade vibes from the U.S. and China + spicy ETF inflows = moon potential.

President Trump eased up on trade beef with China and the UK, and the market’s loving it. Less drama = more risk-on. Meanwhile, BlackRock’s Bitcoin ETF is guzzling supply like it’s bottomless brunch—$667M+ in a single day? Wild.

Shorts are sweating hard too—$1.2B in short positions near $108K might get roasted if BTC keeps climbing. If that squeeze hits? $120K is not just a dream, it’s next up.

And it’s not just hype. Bitcoin’s been chilling above $100K for weeks. Not some flash pump—this run’s got real legs. Even Asia’s big-money players are ditching dollars for BTC and gold.

TL;DR: Bitcoin’s back, it’s bold, and $120K might hit before the month’s out. If you’re not watching the charts, what are you even doing?

You might also like: Dogecoin Pops 9% in 24 Hours After Musk’s Surprise Tweet