Bitcoin Breaks $112K: Bulls Are Back in Town

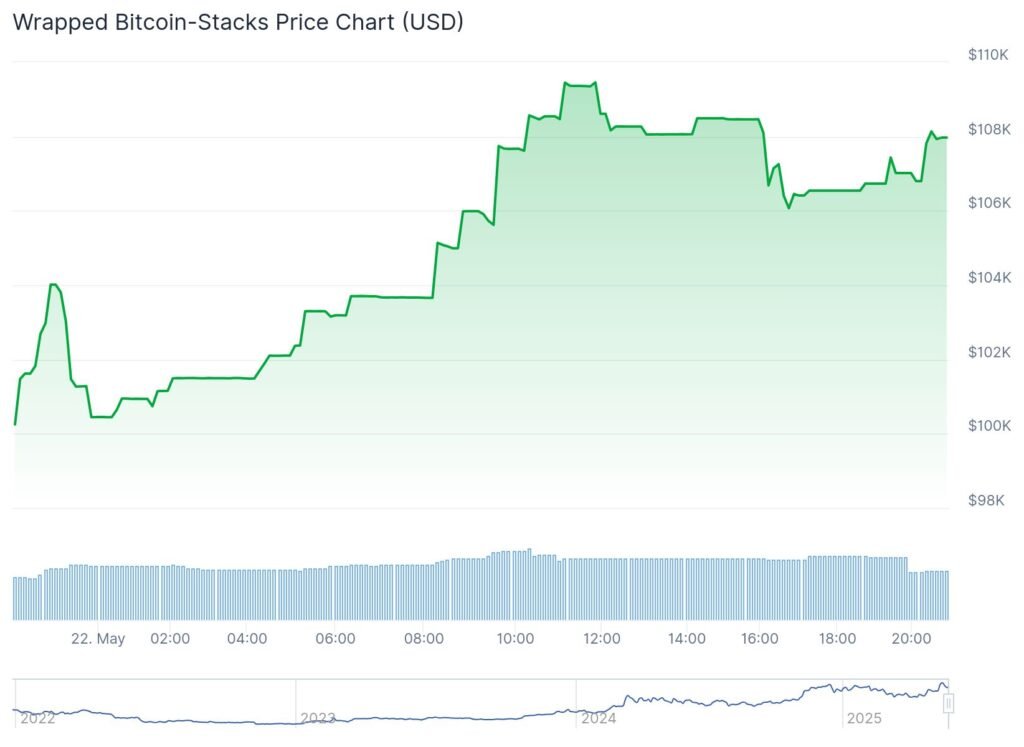

Bitcoin (BTC) just smashed through the $112,000 barrier, setting a fresh all-time high and sending the crypto community into a frenzy. The leading cryptocurrency is currently trading at $109,526, marking a significant milestone in its 2025 rally.

This surge isn’t just a fluke. Trading volumes have skyrocketed, reflecting heightened investor interest and bullish sentiment. Analysts point to a combination of institutional adoption, favorable macroeconomic factors, and increasing public interest as key drivers behind this momentum.

The recent price action has also led to a spike in open interest in Bitcoin futures, indicating that traders are betting on continued upward movement. However, some caution that such rapid gains could lead to short-term corrections.

Despite potential volatility, the overall outlook remains positive. With mainstream adoption on the rise and more financial instruments incorporating BTC, the path to $120K and beyond seems increasingly plausible.

YOU MIGHT ALSO LIKE: Trump’s EU Tariff Plan Wrecks Crypto: Bitcoin Dips to $108K, $100B Wiped Out