‘Coinbase’ Altcoin Soars 235%, But It’s Not the Real Deal

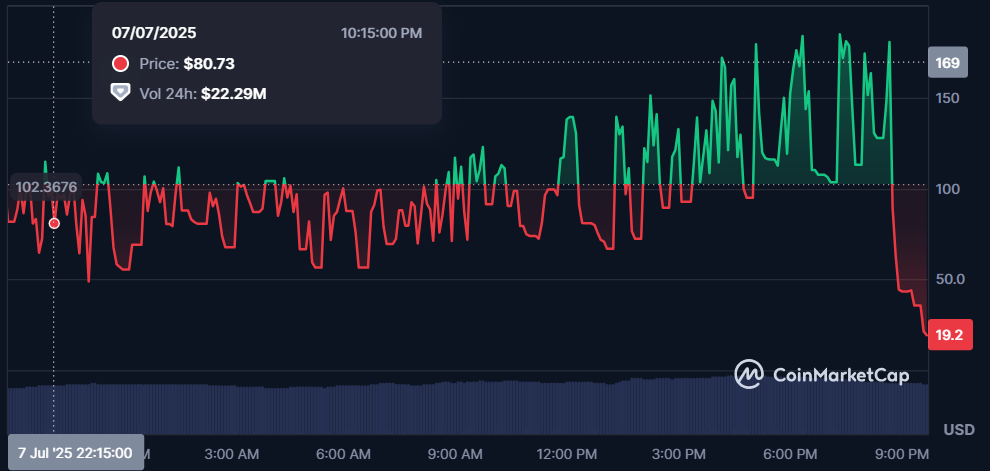

A newly launched crypto token named “Coinbase (COIN)” has sent shockwaves through the market after surging over 235% in just 24 hours—despite having no connection to the real Coinbase Global Inc. (NASDAQ: COIN).

The altcoin, which appears to mimic the branding of the popular U.S. crypto exchange, has rapidly climbed to a market cap of $23 million. Since its launch, the token has delivered a jaw-dropping 2,800% return, raising both eyebrows and regulatory concerns across the crypto community.

Meanwhile, actual Coinbase stock has remained relatively stable, gaining just 0.57% on the day. It opened at $354.20 and currently trades around $357.84, reflecting cautious investor sentiment despite recent bullish analyst upgrades.

Analysts like Gautam Chhugani from Bernstein recently raised Coinbase Global’s price target from $310 to $510, citing its S&P 500 inclusion, Ethereum Layer-2 innovation, and growing dominance in the U.S. crypto exchange market.

Important clarification: The Coinbase (COIN) token is not affiliated with Coinbase Global in any way. This is explicitly stated on CoinMarketCap, but that hasn’t stopped many traders from confusing the two—especially with the misleading name and ticker symbol.

The episode adds to the growing trend of lookalike tokens trying to ride the wave of established crypto brands. Experts warn retail investors to always double-check project legitimacy before jumping in, especially during volatile surges.

In short, the “Coinbase” altcoin may be pumping now—but it’s no substitute for the real deal. As FOMO spikes, so does the risk of being caught on the wrong side of a speculative play.

You might also like: Bybit Launches Crypto Platform in Georgia with Full Local License