Hyperliquid’s native token, $HYPE, just pulled off a staggering 24% rally this week, climbing from a low of $37.18 to a fresh all-time high of $46.22 before slightly cooling to $45.59. The surge reflects increased excitement around DeFi derivatives and Hyperliquid’s high-speed, gas-free Layer-1 chain: HyperBFT.

Backed by rising momentum, investor interest continues to pour in. With 333.92 million $HYPE in circulation and a market cap of $15.2 billion, liquidity runs deep—further boosted by $463.28 million in bridged TVL on the platform.

In June, institutional capital made a bold entry when Tony G Co-Investment Holdings deployed $438,000 into the token, becoming the first public company to add the token to its treasury. The move underscored growing confidence in its model and utility.

On-Chain Power + Influencer Backing

Hyperliquid’s success stems from its on-chain order books and CEX-like performance, setting it apart from traditional DeFi. Its validator model, requiring 10,000 $HYPE for staking, ensures security and alignment among participants.

Hype for altcoins began brewing in late May, fueled by Arthur Hayes‘ bullish price call and the endorsement of trader James Wynn, both of whom placed heavy bets on $HYPE. Hayes has since accumulated millions of tokens himself, intensifying the narrative for an incoming altseason.

Technical Analysis: $HYPE at a Decision Zone

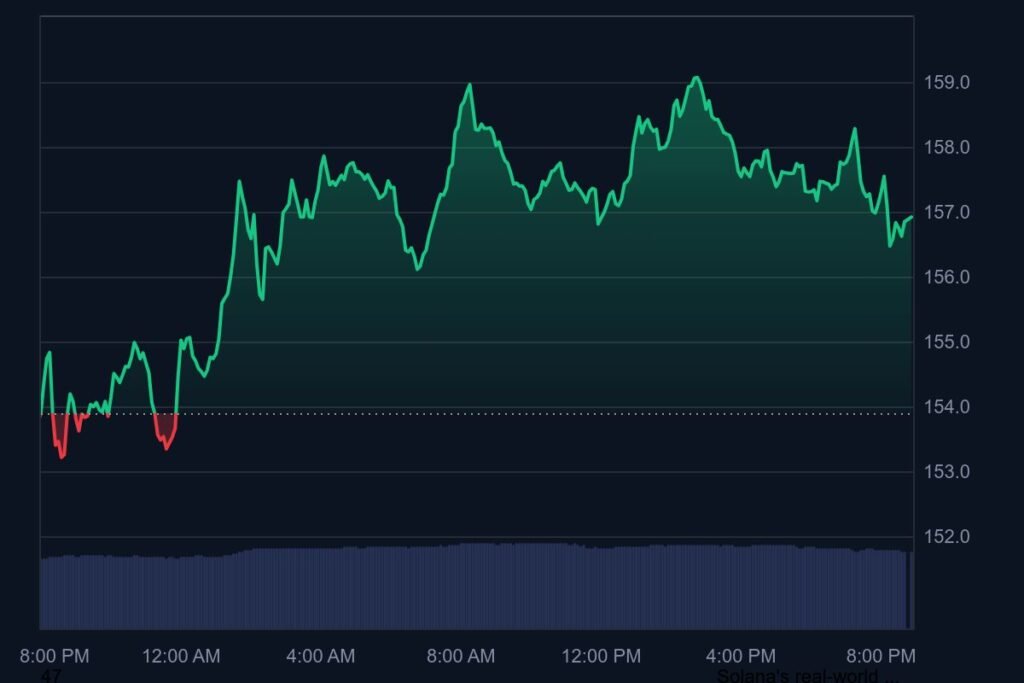

The 4-hour chart shows a clean breakout after two weeks of sideways accumulation near the $37–$39 level. The parabolic move was ignited on July 9 after $HYPE pushed past resistance at $39.7, followed by a vertical move above $41.50.

Price is now battling resistance in the $46.50–$47 zone. While the RSI may soon enter overbought territory, the lack of any meaningful pullbacks during the rally shows aggressive buyer control.

Traders now eye two key scenarios:

- Breakout: If $HYPE clears $47, the path to $50+ opens.

- Pullback: A dip below $44.80 could lead to testing support at $42.50 or even $40.

With volume rising 3.79% in the last 24 hours, $HYPE’s next move could be decisive.

You might also like: $SSK Solana + Staking ETF Crosses $40M AUM in Days — What’s Driving the Surge?