bitcoin today is hovering around $121,500, after trading in a range between $118,000 and $123,000. With sustained institutional demand and strengthening technicals, here are four bold signals that might determine whether Bitcoin accelerates higher—or consolidates further.

4 Bold Signals for Bitcoin Today

- ETF Inflows Reach Historic Peaks

U.S.-listed spot BTC ETFs posted a historic $1.3B in inflows today, making it one of the largest daily net inflow days on record. Institutional conviction and capital entering ETFs continue to tighten supply. - Chart Dynamism: Double-Bottom Breakout Setup

Bitcoin’s price has formed a double bottom near $118K. A breakout above $123K, confirmed with volume, could trigger a sharp rally toward $125K–$130K as traders interpret it as a bullish trend reversal. - Miners HODLing, Not Dumping

On-chain data shows miners accumulating coin balances and moving BTC to cold storage at increasing rates. This suggests reduced sell-side pressure and long-term confidence among network validators. - Macro Risk-On Environment Unfolding

With global markets tilting toward risk assets—thanks to dovish central bank signals and weakening dollar trends—Bitcoin is behaving more like a digital hedge. ETF demand further amplifies its appeal as a core macro asset.

Quick Take:

This bitcoin today piece highlights a powerful setup: massive inflows, a bullish chart pattern, miner confidence, and a favorable macro backdrop. A close above $123K on strong volume could open the door to $130K. But failure to break resistance might lead to consolidation above $120K or a dip toward $118K. Watch ETF metrics, breakout volume, and miner wallet flows for the next major move.

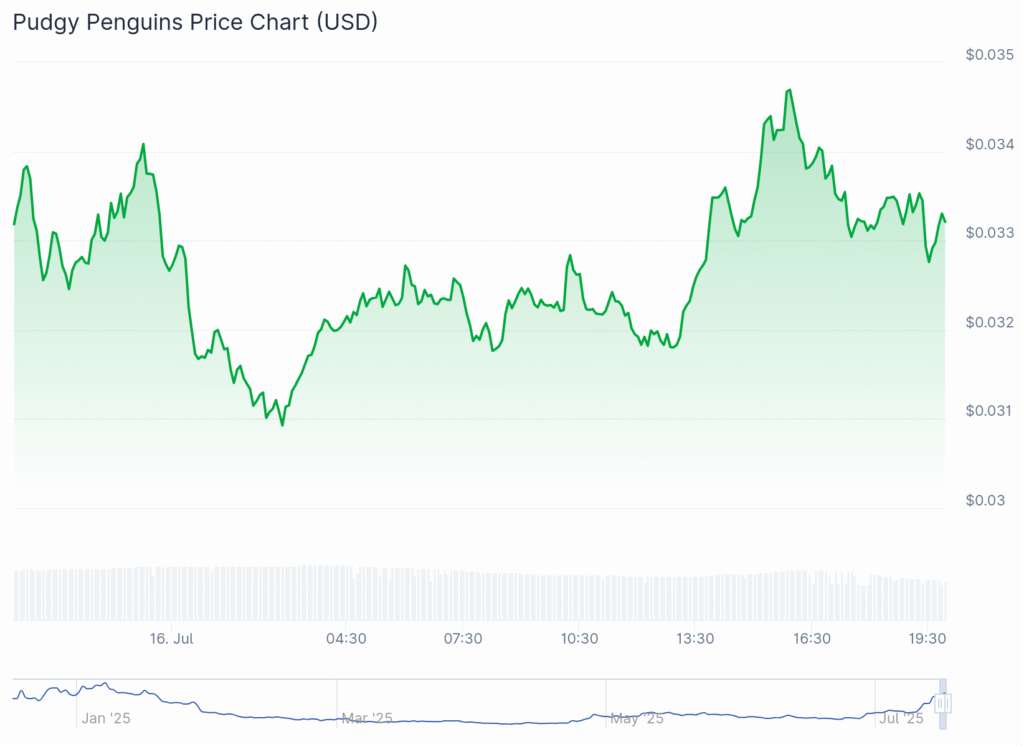

YOU MIGHT ALSO LIKE: Pudgy Penguins ($PENGU) Soars 127% in 7 Days: ETF Rumors & Whale Buys Fuel Memecoin Frenzy