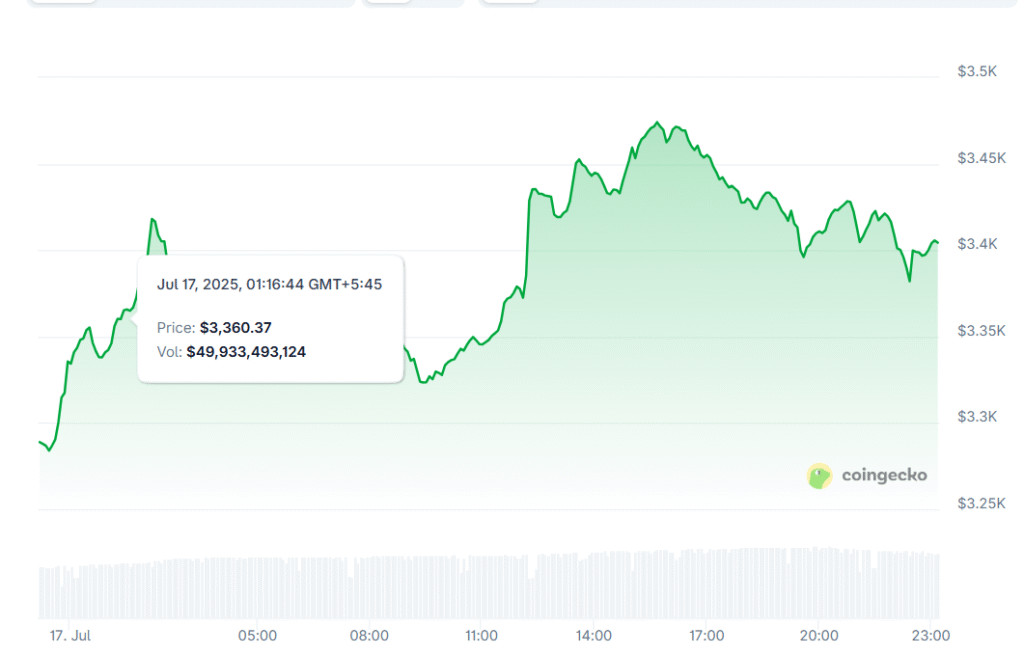

ETH price analysis shows ETH around $3,797, rebounding strongly from an intraday low of $3,543. Multiple powerful indicators are converging, pointing toward looming upward momentum. Here are four critical signals:

4 Key Triggers in Today’s Ethereum Price Analysis

- Massive Spot ETF Inflows

Spot Ethereum ETFs have seen explosive growth—recording over $726 million in daily inflows recently and surpassing $7 billion in cumulative capital, signaling surging institutional demand. - Staking Volume Nears 37M ETH

On-chain data shows about 36.1 million ETH staked, roughly 30% of total supply. This sustained staking limits sell-side pressure and supports scarcity-based upward pricing. - Ascending Channel & Inverted H&S Pattern

Technical charts reveal ETH is forming an ascending channel, alongside an inverted head-and-shoulders with a neckline around $4,000—a clean breakout here could trigger a rally toward $4,200+. - High On-Chain Usage & Network Growth

Ethereum’s network usage remains robust—daily transactions, active wallets, and gas usage are near multi-month highs, reinforcing demand for ETH as utility drives growth.

Quick Take:

This ETH price analysis highlights a bullish setup: explosive ETF inflows, record staking levels, bullish chart formation, and strong on-chain engagement. A decisive volume-backed close above $4,000 may spark a rally toward $4,200+. Failure to hold $3,750 could risk a dip back to $3,600. Traders should monitor ETF flows, staking trends, breakout confirmation, and network metrics for guidance.

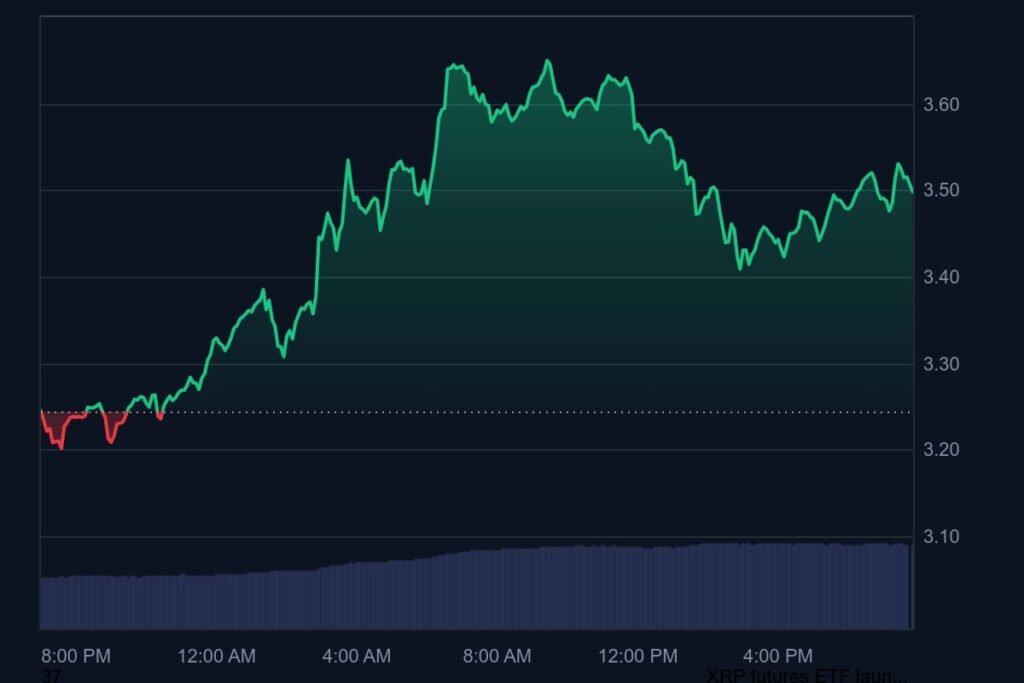

YOU MIGHT ALSO LIKE: XRP ETF Launch Could Send Price to $4.80—SUBBD Presale Nears $1M as New Altcoin Rises