Ethereum Price Analysis: Is ETH on Track for a $4,000 Breakout?

Our latest ethereum price analysis shows ETH holding near $3,712, flashing strength between its intraday low of $3,529 and high of $3,757. With several compelling indicators aligning, here are four strategic signals moving the needle:

1. Continued ETF Inflows Fueling Momentum

Ethereum spot ETFs have attracted $332 million in inflows today, marking a 14-day streak of institutional buying and flipping Bitcoin’s ETF volume dominance.

2. Rising Network Metrics and New Users

Ethereum’s cumulative unique addresses reached 329 million, up 20% year-over-year, while daily active addresses hover around 580,000—both metrics pointing to steadily growing usage.

3. First-Time Buyers Surge, Trend Reversal Brewing

On-chain data from Glassnode reveals that the supply of ETH held by first-time buyers jumped 16% since early July. This influx of fresh capital often signals early stages of a bullish phase.

4. Technical Setup: Approaching Critical Resistance

ETH appears to be forming an ascending pattern with a breakout zone between $3,800 and $3,900. Given the converging ETF momentum and buyer influx, a clean breakout could open the path to $4,000+.

Quick Take:

This ethereum price analysis uncovers a strategic setup: strong ETF inflows, supportive on-chain metrics, new buyer influx, and technical readiness. A breakout above $3,900, backed by volume, could launch ETH to $4,000. Conversely, failure to hold support near $3,500–$3,600 could trigger a short-term pullback. Monitor ETF data, on-chain growth, and breakout strength for next steps.

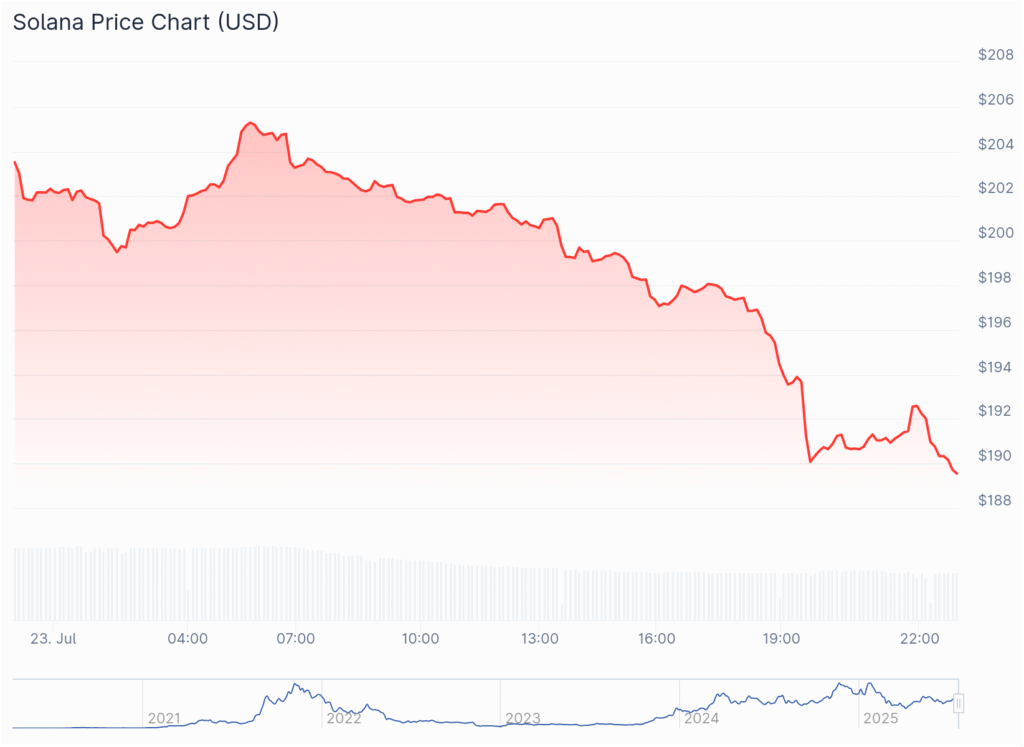

YOU MIGHT ALSO LIKE: Solana Rally Sparks 30% Surge in Fartcoin | Altcoin Season Heats Up