Ripple Just Slipped Is This a Healthy Dip or Major Red Flag?

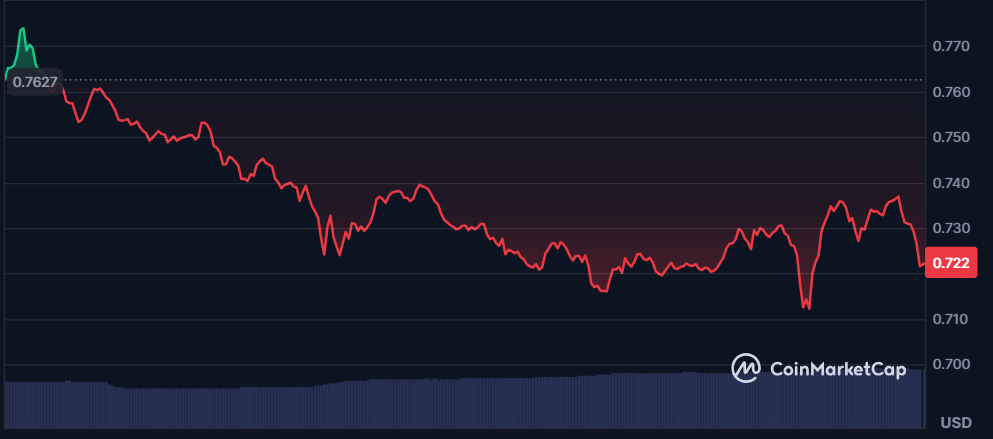

Ripple was living the dream just days ago, hitting highs over $3.25 and giving major breakout energy. But fast forward to today? It’s a whole different vibe XRP just cracked below the $3 line, and traders are sweating.

XRP Breakdown: Key Levels to Watch Now

The drop follows some massive whale moves, including a $175M Ripple transfer by Ripple co-founder Chris Larsen. Yeah that kind of movement always shakes the market. Right now, XRP’s floating around $3.02, dangerously close to the next major support at $2.75.

Charts are looking rough. Ripple faced major resistance near $3.50–$3.75, and after multiple rejections, the bulls lost steam. What used to be breakout zones like $3.25 have flipped to resistance not a good look. The RSI? It’s fallen from an overheated 80 to a lukewarm 52.5. Volume is fading too.

If XRP breaks $2.75, it could drop further to $2.50 or even $2.31 zones where it chilled during past consolidations. Short-term vibes are definitely bearish. But if bulls pull a miracle and reclaim $3.25+, XRP could aim for $3.50 again.

TL;DR: All eyes are on whether $2.75 holds. If not, we might be entering full correction mode.

YOU MIGHT ALSO LIKE: Bitcoin Dips Below $115K After Trump’s Tariff Order Shakes Global Markets