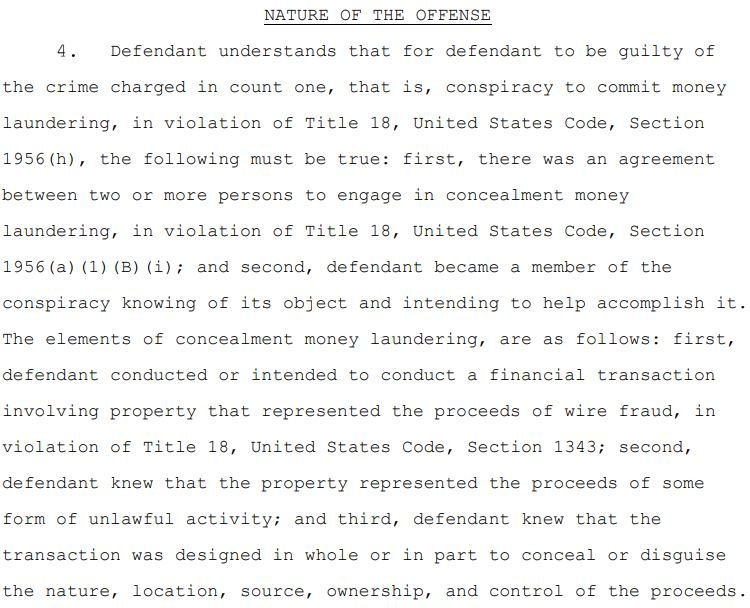

Ilya Lichtenstein, the man behind the infamous 2016 Bitfinex hack which resulted in $71M (now billions) being stolen, has got 5 years in prison for laundering with his wife, Mrs. Heather Morgan. They used every shady techniques like creating fake ID’s, darknet markets, and NFTs to hide their funds. After finally being caught Lichtenstein cooperated and helped solve cybercrime cases while his wife is also facing sentences soon.

Ilya Lichtenstein from Russia is has been sentenced to five years in prison for working together with his wife to steal and launder billions of cryptocurrency. His wife is a rapper who goes by the name “Razzlekhan” on her social media and she also pleaded guilty last year for their heinous crimes. Reportedly, Morgan has faced an 18 month sentence recommendation and that will be finalized on November 18.

You might also like: Pennsylvania Looks to Build Bitcoin Reserve

This case dates back to 2016, the time when Lichtenstein managed to hack into the Bitfinex exchange, stealing 119,754 Bitcoin worth $71 million at the time. The recent surge of Bitcoin makes the overall stolen amount rise to billions of dollars. The scale of this money and the complexity involved in the case has made this one of the most infamous heist in crypto.

Judge somewhat praised Lichtenstein by calling his Bitcoin heist super calculated. He and his wife both, used fake IDs, crypto exchanges, and even bought NFTs to hide stolen funds. However, after pleading guilty he cooperated with cyber police force and is also helped them solve other cybercrime cases. He showed remorse and promised to fight against cybercrimes. This case really highlights how wild crypto crimes can get.