Ukraine is considering legalizing crypto but won’t allow it for payments, says NBU Governor. The country also tests its digital currency, the e-hryvnia.

Ukraine Crypto Legalization On the Table But NBU Draws the Line at Payments

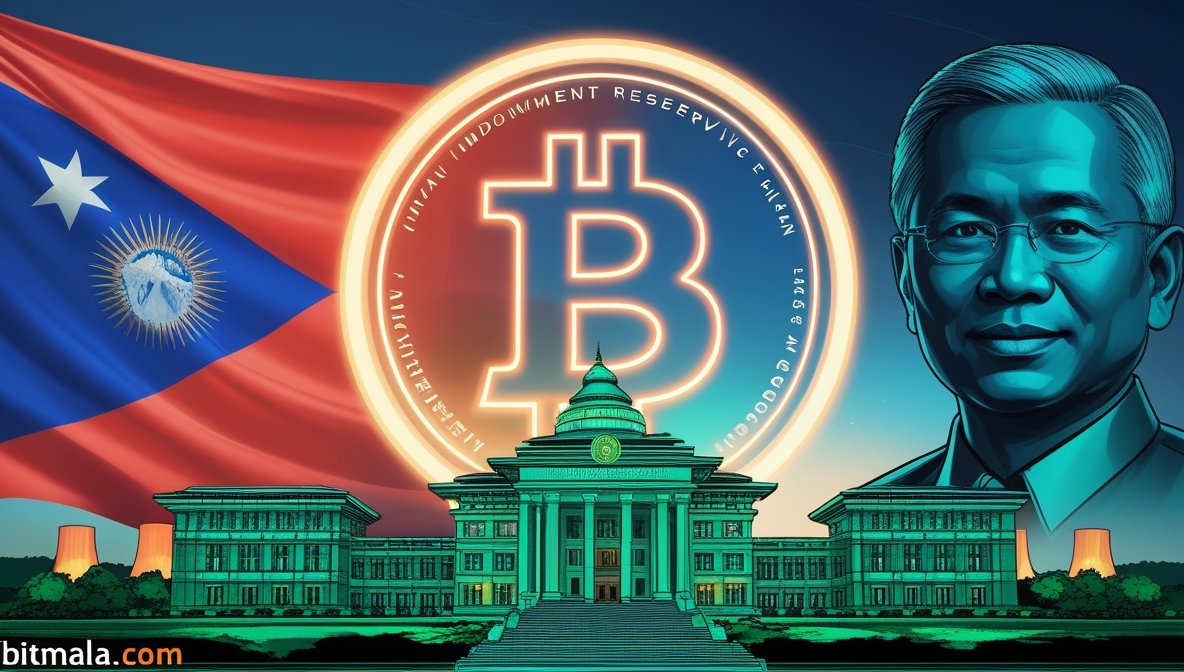

Ukraine might be the next country to join the crypto-friendly club, but it’s being very clear on its boundaries. The National Bank of Ukraine (NBU) is exploring ways to legalize crypto, but it has no plans to let Bitcoin or other tokens be used for payments.

NBU Draws the Red Line

In an interview with RBC-Ukraine, NBU Governor Andriy Pyshnyy said crypto might play a role in Ukraine crypto’s financial future just not as money. “Virtual assets cannot be a means of payment,” he said, explaining it could hurt the bank’s ability to control the economy, especially in times of war.

That means while crypto might become legal, it won’t replace the hryvnia, and definitely won’t be used to bypass currency controls during martial law.

UKRAINE CRYPTO: Playing by Global Rules

Pyshnyy also emphasized that any crypto law must follow FATF standards and align with EU regulations, with clear systems to track transactions and prevent illicit activity.

At the same time, the bank is testing its own CBDC, the e-hryvnia, in partnership with tech developers. This pilot will help shape future decisions as the NBU watches how other global banks like those in France, Singapore, and Germany are building their own digital currencies.

Interestingly, a draft law proposed in June could even allow the NBU to hold Bitcoin in its national reserves a sign that Ukraine crypto’s future is getting real.

YOU MIGHT ALSO LIKE: CrediX Vanishes After $4.5M Hack Exit Scam Fears Mount