Bitcoin Slips as Fed Holds Rates Steady — What’s Next for the Markets?

The U.S. Federal Reserve has decided to leave interest rates unchanged at 4.25%-4.50%, marking the sixth straight meeting without a hike. The decision reflects caution amid a cooling economy, but also dashed hopes of more aggressive rate cuts in the coming years.

The Fed’s updated outlook cuts 2025 GDP expectations to 1.4%, while raising the inflation forecast to 3% — a combo that signals slower growth and sticky prices. Their “dot plot” now projects just two rate cuts in 2025, fewer than previously anticipated, and only minor reductions into 2026 and 2027.

Bitcoin (BTC), which had been hovering above $104,500, slipped to $104,128 following the announcement. The drop came after the Fed signaled a more hawkish stance than markets were expecting.

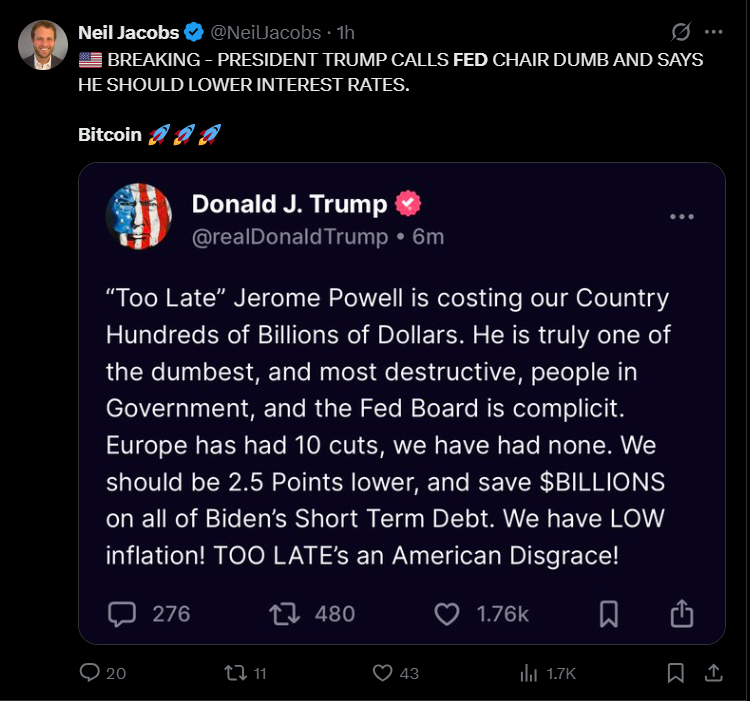

Adding political heat, former President Donald Trump called Fed Chair Jerome Powell “stupid” just hours before the update, accusing him of over-tightening the economy.

One notable change: the Fed’s statement removed previous concerns about unemployment and inflation, noting that while uncertainty has “lessened,” it’s still a factor. 7 of the 19 Fed officials now expect no rate cuts at all this year, compared to 4 in March.

Despite the disagreement, the committee voted unanimously to hold rates steady, highlighting how the Fed remains cautious amid mixed economic signals.

For Bitcoin and broader markets, the outlook stays bumpy — but with less hope for cheap money anytime soon.

You might also like: 4 Bullish AVAX Price Analysis Signals You Need to Know Today