Summary

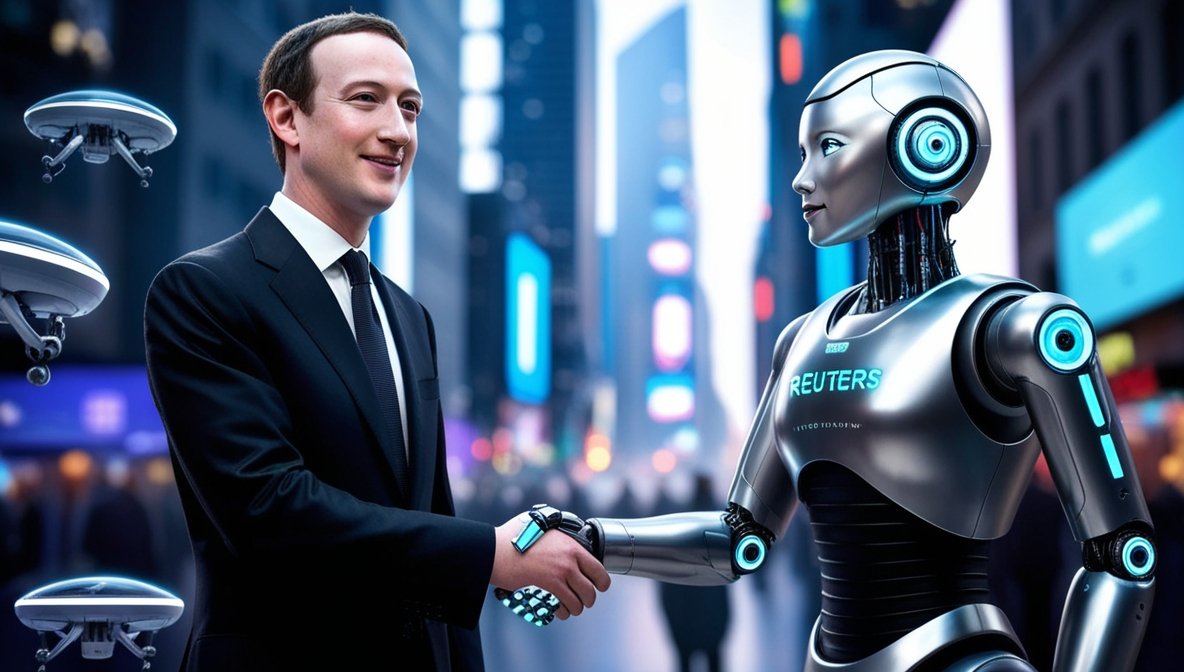

Meta’s latest AI tech aims to level up the way we get our news, thanks to the new collab with Reuters. They’ve locked a multi-year deal and are letting Meta’s AI chatbot serve real time Reuters news straight to meta applications. Now we can get the updates just by asking!

The latest AI technology from Meta, a multi-billion dollar company famous for its social media platform, have made collaboration with Reuters, a global news organization known for their reliable, real-time news and information delivery. This is a multi year partnership and it is set to change the way we perceive news.

Basically there is going to be a chatbot in users’ any meta apps like Messenger, Instagram, WhatsApp and Facebook, where user can ask that bot about the news they want to know about. Its like having an intelligent friend who is up to date with all the latest news. Users are promised to receive accurate, up-to-date information alongside links to Reuters’ full coverage.

This collaboration is also a step up for Meta’s AI integration programs. It boosts engagement on its platform while also supporting news organizations. This initiative is just a part of Meta’s broader AI strategy. Some of its plans include AI driven customer service on WhatsApp and predictive content features on Facebook. These innovations show how Meta’s ambition to transform interaction with information.

AI is rapidly becoming more mainstream, similar to meta many other big tech companies are also investing on the advancement of AI. This further increases chances of AI crypto being face of the market.

Read similar topic: Vaneck launches fund of $30M to boost Fintech, Crypto and AI startups