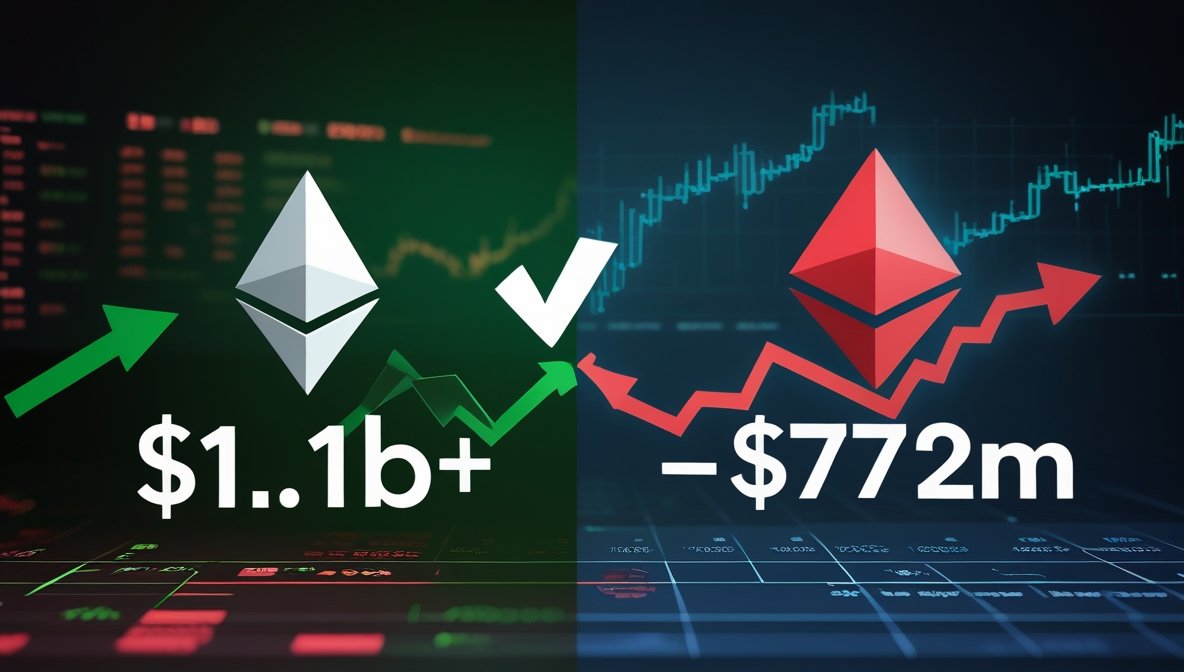

Summary: Ethereum’s stablecoin supply jumped by $1.1 billion in just a week, while Solana saw a $772 million decline. Analysts say Ethereum’s lower gas fees and technical improvements are driving demand for USDT and USDC on the network.

Ethereum is seeing a fresh wave of stablecoin activity, with on-chain data showing a $1.1 billion increase in USDT and USDC supply over the past week. Concurrently, Solana has witnessed a precipitous fall of $772 million, with questions raised regarding changing market trends.

YOU MIGHT ALSO LIKE: Nigeria Government vs. Binance’s Tigran: A Clash Over Corruption Allegations

Ethereum and Solana dominate the stablecoin market to a great extent, but recent patterns indicate Ethereum taking momentum back, as per blockchain analytics platform Lookonchain. The drop in gas fees and continuous improvements in Ethereum’s infrastructure have made it a more attractive option for stablecoin transactions, bringing fresh liquidity back to the network.

Meanwhile, Solana has lost nearly $780 million in stablecoin supply, with no clear explanation.Others believe network stability problems and changing user needs may be pushing funds elsewhere.

YOU MIGHT ALSO LIKE: Is XRP Partnering with Elon Musk to Hit $600? Fact or Fiction?

Data from DefiLlama shows Ethereum still leading the stablecoin market with over $122.9 billion in supply, or 54.63% of the total supply. Solana, however, has just 5.15%—around $11.58 billion.

These shifts reflect the constantly shifting nature of crypto markets, in which small fluctuations in cost, speed, and reliability can quickly influence where consumers would rather transact.