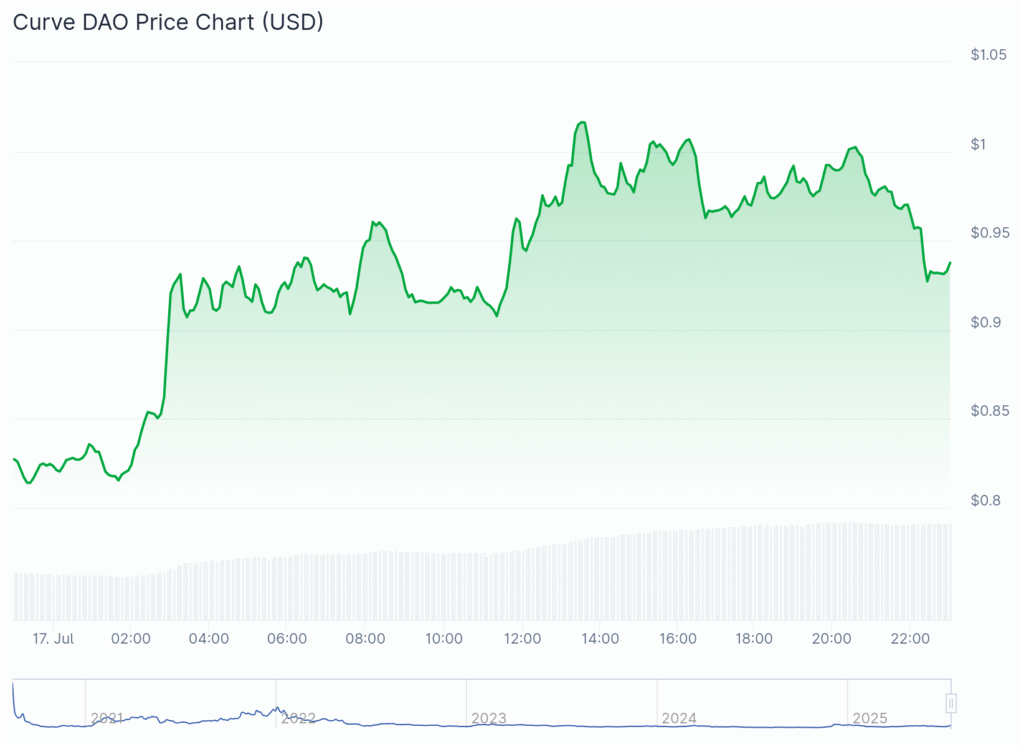

Curve DAO’s native token, $CRV, has been on fire this week. The token rebounded sharply from a weekly low of $0.6017, soaring over 79% and trading at $0.9882 at the time of writing—a 22.9% gain in just the last 24 hours.

While some mid-week profit-taking slowed the climb temporarily, fresh momentum has kicked in, fueled by renewed governance interest and upcoming protocol upgrades.

According to CoinGecko, on-chain metrics underline this resurgence. Its 24-hour trading volume skyrocketed to $848.37 million, signaling increased trader participation. With a market capitalization of $1.33 billion, $CRV now ranks among the top DeFi governance tokens.

$CRV is the heartbeat of Curve DAO’s governance and rewards system. With 2.28 billion total tokens and over 93,000 active holders, $CRV holders help steer the DAO’s decisions, particularly those locking tokens via vote-escrow (veCRV) for amplified governance power and liquidity rewards.

Analysts highlight Curve’s active community and decentralized governance as key drivers behind $CRV’s strong rebound.

Curve’s Total Value Locked (TVL) stands at roughly $2.49 billion across supported chains, as per DeFiLlama data—showing deep liquidity within its ecosystem. Integration with DeFi giants like Yearn Finance, Compound, and Aave has also expanded Curve’s reach and revenue streams.

Recent launches like its expansion onto Polyhedra’s EXPchain—enabling cross-chain stablecoin swaps—and updates like a dedicated DAO Treasury and Block Oracle highlight Curve’s constant evolution.

$CRV Price Analysis: $1 Breakout Incoming?

From a technical perspective, $CRV’s 4-hour chart shows a sharp breakout from a long-standing base. Price action soared from the $0.50 region to near $0.99 in a parabolic move.

Sustained volume spikes back this up. Successive higher highs and higher lows, along with extended bullish candles, suggest aggressive buyer dominance. Positive volume delta footprints reinforce this, although notable selling at highs suggests profit-taking is emerging.

Currently, the $1.00 psychological barrier acts as a key battleground. A confirmed breakout above this could push $CRV toward $1.05 or higher. Conversely, failure to hold above the $0.94–$0.96 support zone may trigger a retracement toward $0.88.

With intensified buyer flow and cautious selling pressure near the top, traders are watching closely to see whether $CRV can decisively break above $1 or face a temporary setback.

You might also like : Ethereum Today: 4 Bold Clues Hinting at a Surge Toward $4,200