SolanaSurge: Why SOL Is Up Badass Numbers Right Now

The SolanaSurge is back — and this time it’s real. SOL just flipped $200 for the first time since the 2021 bull run, and Gen Z traders are calling it the comeback of the year. In just the past 30 days, Solana’s spiked 47%, and the energy’s straight-up bullish.

What’s fueling the rise? First up, SOL’s recent Firedancer upgrade seriously boosted network speed and cut down gas fees even more. That means more users, smoother transactions, and devs are loving it.

Then there’s the DeFi wave. TVL (total value locked) on SOL just hit $3.9 billion — up from barely $500M last year. Big-name projects like Jupiter, Drift, and MarginFi are making noise, and users are flooding in. Even NFT traffic on Solana’s back on the rise with high-volume mints and cleaner marketplaces.

Also: no more random outages. The tech’s finally holding it down, which was everyone’s biggest complaint before. So now it’s not just “fast,” it’s actually reliable.

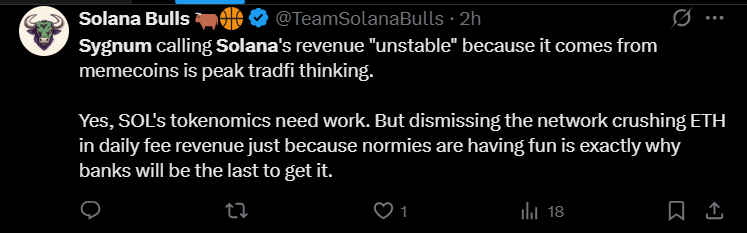

Solana’s growing so fast, even some Ethereum maxis are testing the waters. Plus, with new integrations on major apps and exchanges, people can’t ignore it anymore.

So yeah, the SolanaSurge isn’t just hype — it’s got fundamentals behind it now. If SOL keeps this up, it might just be the chain that breaks out hard in 2025.

YOU MIGHT ALSO LIKE: Breaking !3 Key Catalysts Boost Pepe Coin Price—Is a 125% Rally on the Horizon?