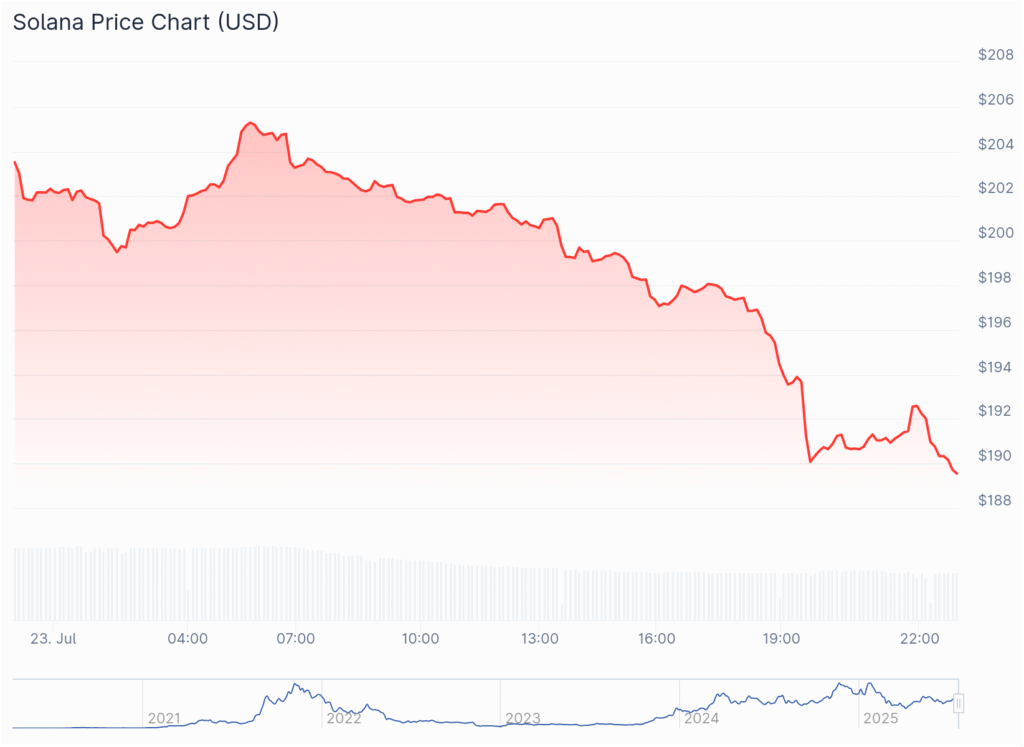

Solana’s native token SOL has broken the $200 barrier for the first time since late July, surging 15.67% in the past 24 hours to $201.22. This rally pushes its weekly gain to over 23%, far outpacing the broader crypto market’s 4.2% rise.

The breakout follows bullish corporate news. Nasdaq-listed Upexi Inc. announced the creation of a Solana-focused advisory board headed by BitMEX co-founder Arthur Hayes, along with a $316 million SOL holding. Upexi’s shares jumped 20% in pre-market trading on the news.

Solana’s market cap now stands at $108.59 billion, with 24-hour trading volume soaring 118% to $12.71 billion. Corporate buying has become a significant factor, with public companies reportedly holding around 8% of SOL’s circulating supply. This concentration creates scarcity, potentially driving prices higher.

The $200 level serves as a key psychological threshold and a signal of renewed market strength. SOL briefly hit $205.87 before easing back. Analysts are watching to see if it can maintain this level, with support from institutional interest and a broader altcoin rally.

Solana’s gains come as Ethereum’s market share drops to its lowest since December 2024, reinforcing SOL’s position as a leading altcoin in the current market cycle.

You might also like: 3 Insane Reasons Pump.fun’s $33M Buyback Is Sending PUMP Token Skyrocketing