ARK Invest CEO Cathie Wood has predicted that most memecoins will eventually become “worthless,” cautioning investors to stay clear of viral tokens. In an interview with Bloomberg, Wood expressed her skepticism toward internet meme-based coins and AI-generated tokens, saying they “won’t be worth very much” in the future.

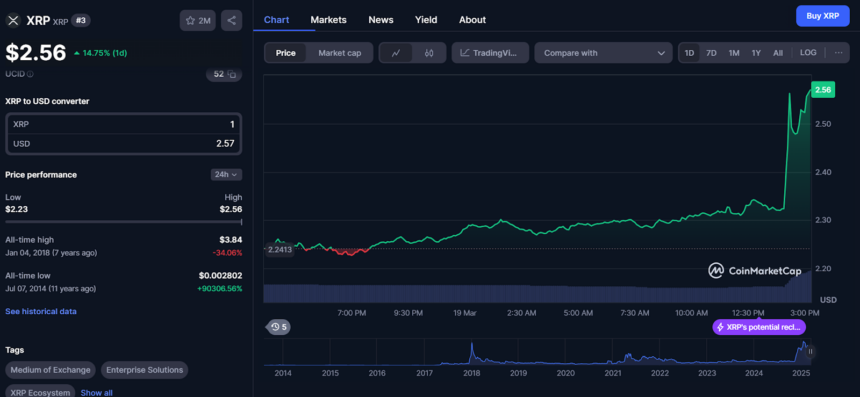

Instead of backing these speculative coins, Wood focuses on established cryptocurrencies such as Bitcoin, Ethereum, and Solana, which she believes will grow stronger over time. She emphasized that the market is volatile, with many losing substantial value as shown in this post.

“There’s nothing like losing money for people to learn,” Wood said, warning traders that the SEC and regulators are not taking responsibility for meme coins. However, Wood did single out the TRUMP Official Token as one of the few that could “withstand the test of time.”

Why Memecoins Are Heading Toward Worthlessness

The meme coin market, once worth over $137 billion in December 2022, has lost more than 60% of its value, now standing at $51.6 billion. This downturn includes sharp crashes in tokens like the LIBRA meme coin and the TRUMP meme coin, which has fallen nearly 85% from its peak.

On-chain data from ARK Intelligence highlights significant losses in the meme coin sector, including a portfolio of viral meme coins held by analyst Murad Mahmudov, which saw an 80% drop in just two months.

YOU MIGHT ALSO LIKE: Bitcoin Tanks 25% – Warning Sign or the Biggest Rally Ahead?

Despite some recent growth in global liquidity and the weakening U.S. dollar, the memecoin market has shown little signs of recovery, with platforms like Pump.fun experiencing significant revenue declines.

As the memecoin market flounders, Wood’s cautionary message stands as a stark reminder for investors.