Tether (USDT) Dominance: Key Insights for Traders in 2025

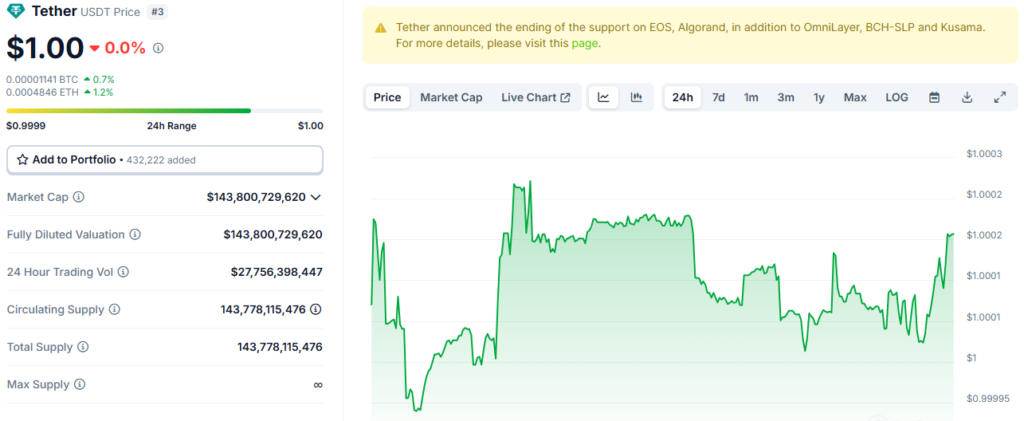

Tether (USDT) is maintaining its stronghold in the cryptocurrency market, solidifying its place as the leading stablecoin. On March 25, 2025, Paolo Ardoino, CEO of Tether, tweeted about the company’s continuing dominance, which was featured in an analysis by ABC Money. The article emphasized Tether’s central role in the crypto ecosystem, noting that USDT’s market cap reached $112 billion by March 25, 2025, representing nearly 70% of the entire stablecoin market.

Tether’s Market Impact: Liquidity & Trading Volume

USDT’s dominance is evident in its staggering 24-hour trading volume of $56.3 billion, according to CoinGecko. This liquidity makes USDT an essential asset for crypto traders. As of 11:00 AM UTC, USDT was involved in 52% of all trades on major exchanges like Binance and Coinbase (source: CryptoCompare). Its significant presence in the market ensures that large trades can be executed without heavily impacting prices, creating a more stable and efficient trading environment.

Moreover, on-chain data indicates that the number of USDT transactions on the Ethereum network surged by 15% in the last week, hitting 1.2 million transactions as of March 25, 2025 (source: Etherscan). This uptick in transactions highlights the growing reliance on Tether for executing transactions and storing value within the crypto ecosystem.

Market Sentiment & Volatility

The dominance of USDT also influences broader market sentiment. For example, on March 25, 2025, the USDT/USDC trading pair saw a slight increase in value, suggesting that traders are preferring USDT over USDC at this moment (source: CoinDesk). As USDT remains the go-to stablecoin for trading pairs, its dominance can increase volatility in other cryptocurrencies, with traders using USDT to shift between volatile assets.

The ETH/USDT pair on Kraken saw a 3% increase in trading volume, totaling $3.2 billion in the last 24 hours as of 3:00 PM UTC (source: Kraken). This suggests that traders continue to use USDT as a safe base for trading more volatile cryptocurrencies.

Technical Indicators for USDT in March 2025

From a technical perspective, Tether’s dominance is supported by several key indicators. The Moving Average Convergence Divergence (MACD) for the USDT/BTC pair showed a bullish crossover on March 25, 2025, indicating potential upward momentum (source: TradingView). Additionally, the Relative Strength Index (RSI) for the pair stood at 62, reflecting a balanced market without signs of being overbought or oversold (source: TradingView).

High trading volumes for USDT across major exchanges like Huobi, which reported a 24-hour volume of $45 billion (source: Huobi), further indicate that Tether remains a primary asset for traders. Furthermore, the average transaction size for USDT on the Tron network increased by 10%, reaching $15,000 over the last week (source: TronScan), showing that larger investors are increasingly turning to Tether for their transactions.

Key Takeaways for Traders

Tether’s dominance in the crypto market as of March 25, 2025, has significant implications for traders. The stability and liquidity offered by USDT are crucial for executing large trades and ensuring efficient market movement. Its influence on market sentiment, trading volume, and on-chain activity is undeniable. Traders should closely monitor USDT’s market share, transaction volumes, and technical indicators to capitalize on the opportunities it presents.

Also Read: Ethereum’s Price Struggles: Is a $1,200 Crash Incoming?