Bitcoin bulls just got a major confidence boost.

Geoffrey Kendrick, Head of FX and Crypto Research at Standard Chartered, has reiterated his sky-high outlook for Bitcoin, predicting it will soar to $120,000 by Q2 2025 and possibly hit $200,000 before the year ends.

In a note released on April 28, Kendrick laid out several macro and on-chain factors fueling the forecast — including whale accumulation, massive ETF inflows, and a rising U.S. Treasury term premium, now sitting at a 12-year high. He believes these signs point to a capital shift away from U.S. bonds and into crypto, particularly Bitcoin.

Bitcoin’s past price cycles also support this view. Historically, sideways trading has often been followed by aggressive price pumps — and Kendrick thinks we’re right on the edge of one.

Also worth noting: Standard Chartered and other global banking giants like Deutsche Bank are ramping up their crypto activity in the U.S., especially as the industry bounces back post-FTX. This move aligns with a renewed pro-crypto narrative being pushed by political figures, including Donald Trump, who recently promised to make the U.S. more crypto-friendly.

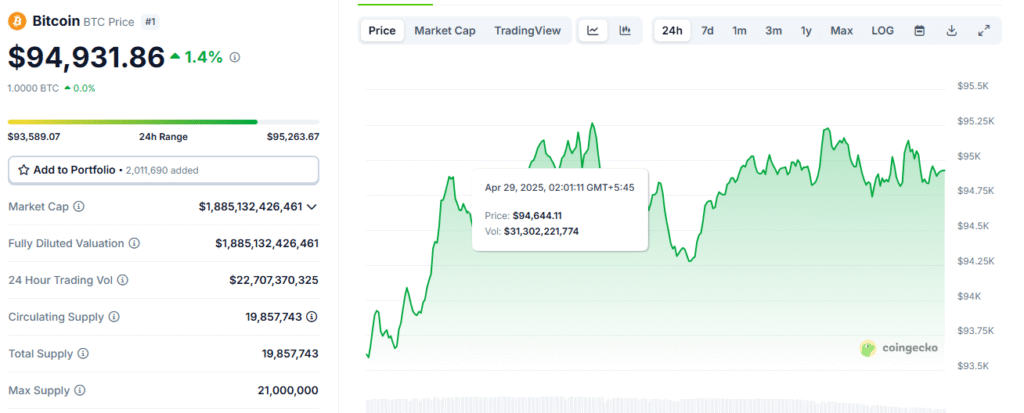

At the moment, Bitcoin is hovering around $95,000, up 7x from its bear market low in November 2022. A move to $120K in Q2 would not only set a new all-time high but also potentially spark a wave of FOMO that could carry BTC to $200K by December.

So yeah — if Kendrick’s right, this next leg could be the one that turns heads across both Wall Street and Main Street.

You might find interesting: Breaking ! Bitget Sues Traders After VOXEL Token Manipulation Nets $20M