LockBit Leak Reveals Ransomware’s Crypto Trail

A major blow just landed on one of the most feared ransomware groups online. Hackers broke into LockBit’s dark web affiliate panel and leaked nearly 60,000 Bitcoin addresses used by the group in ransom attacks. It’s one of the biggest leaks ever tied to a cybercrime ring and could change how investigators track these operations.

The leaked database contained 20 detailed tables, including one listing custom ransomware tools made by LockBit affiliates and another with over 4,400 messages between the group and their victims. While no private keys were leaked, the exposure of the addresses gives law enforcement a rare chance to trace payments and map LockBit’s financial footprint.

To top it off, the hackers behind the breach left a taunt: “Don’t do crime. CRIME IS BAD xoxo from Prague.” The same message was used in a separate ransomware gang takedown, suggesting a rogue vigilante group is going after these criminal networks.

LockBit has been under fire for a while. In early 2024, a ten-nation task force moved to dismantle its operations. This leak only ramps up the pressure. And with crypto always in the middle of these schemes, the transparency of blockchain might finally give defenders the upper hand.

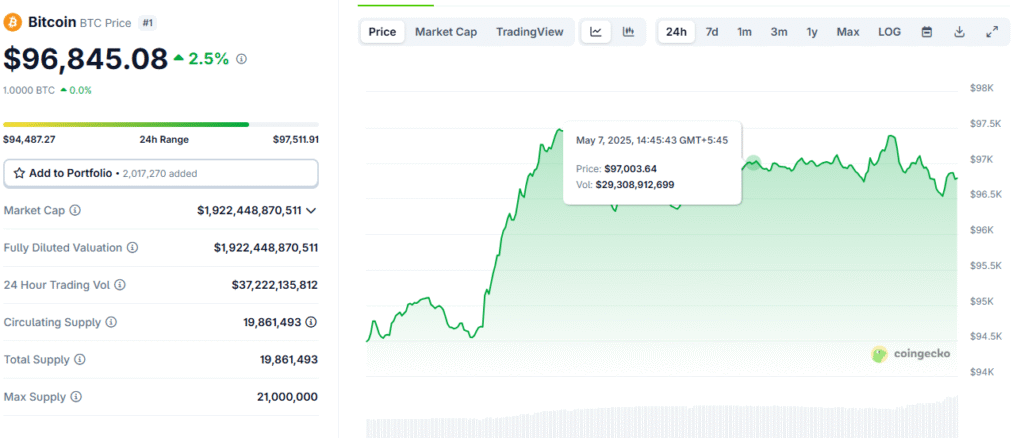

YOU MIGHT ALSO LIKE: Breaking !Bitcoin’s Stuck at $96K — Will the Fed Send It Over $100K Today?