XRP (XRP) is leading the top 5 cryptos this year with a cool +7.5% YTD gain — proving it’s still got gas in the tank even after market turbulence. And with May rolling in, the usual “Sell in May” FUD is looking kinda outdated.

Analysts like CoinBureau’s Nic Puckrin are still bullish. He points out that Bitcoin has pumped in 9 of the last 12 Mays, and institutional money is still flowing into BTC ETFs. That’s usually a good sign for altcoins like XRP.

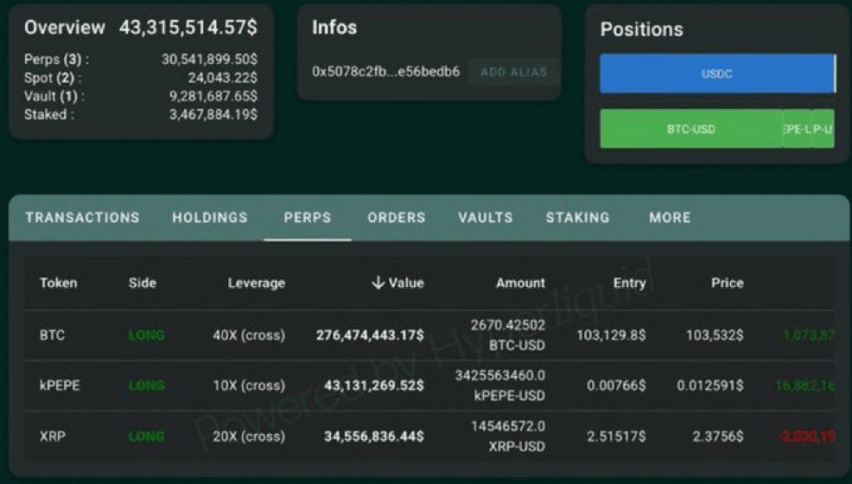

Technically? XRP broke above its descending triangle and is still chillin’ above key moving averages. The 21-day EMA > 200-day EMA — a classic bullish signal. The $2.6 level is the one to watch. If XRP smashes that, another breakout might hit.

But even if XRP cools off a bit, there are new meta plays getting serious traction…

Hot Presale Alert: MIND of Pepe Is Raising Eyebrows (and Funds)

MIND of Pepe is like if AI + meme coin culture had a baby. The project has already raised nearly $9M, and its AI agent is going viral across X. It’s scanning trends, talking to big accounts, and feeding alpha back to $MIND holders.

Still early? Yep. The presale price is just $0.0037515, and analysts think this one’s got legs. Early entries are betting big on its social clout turning into serious ROI.

Ready to ape in? Head to the MIND of Pepe site, connect your wallet, and choose USDT, ETH, or even your card. The future of meme AI might just start here.

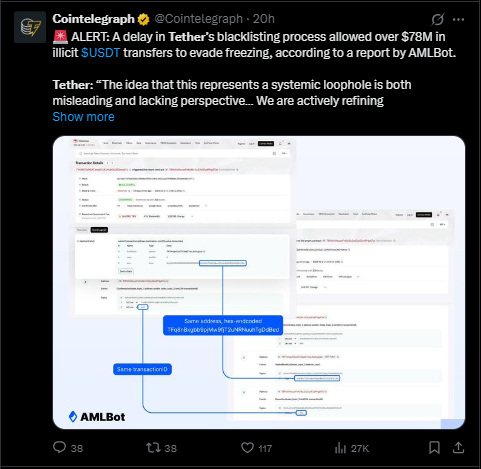

You might also like: Tether’s Blacklist Lag Lets Hackers Move $78M in USDT Before Freeze