Cetus Commits to Making It Right

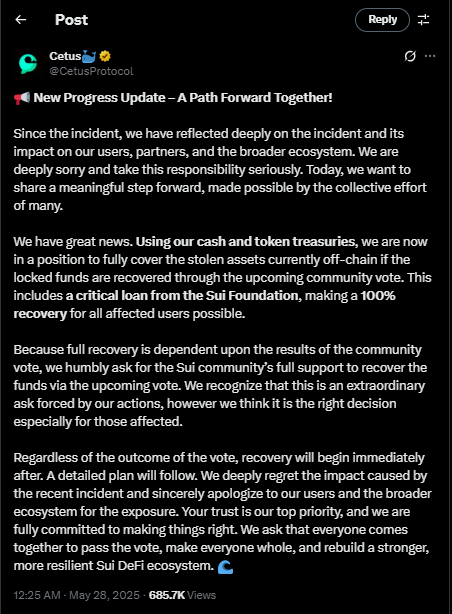

Cetus Protocol just made a huge promise—everyone who lost funds in the $223 million hack on May 22 is getting repaid. After one of the biggest DeFi breaches in 2025, the team is stepping up with a mix of their own funds, a loan from the Sui Foundation, and a community vote to unlock frozen assets.

Right now, $162 million is frozen and off-network. They want to unlock it, but they need the Sui community’s vote. If it passes, that chunk, plus extra funds from Cetus and the Sui Foundation, will cover all losses. Even if the vote doesn’t pass, the team says they’ll still find a way to pay everyone back. Respect.

They’ve admitted the hack was caused by a flaw in their trading system—and they’re owning it. Sui’s chipping in $10 million to level up security, so this kind of mess doesn’t happen again. Cetus dropped the update on X and is rallying support for the vote. Validators and token holders on Sui are in the driver’s seat here.

This isn’t just about damage control—it’s about rebuilding trust. By owning the glitch, planning repayments, and working with Sui, Cetus is showing they’re serious about keeping DeFi solid. A full roadmap on repayments is dropping soon, and eyes are on what happens next.

YOU MIGHT ALSO LIKE: SharpLink Soars 420% as It Raises $425M to Adopt Ethereum Treasury Strategy