Tether CEO Fights Back After 16B Password Leak: Meet PearPass

In response to the largest credential breach in history—reportedly affecting platforms like Google, Meta, and Apple—Tether CEO Paolo Ardoino has introduced PearPass, a fully offline, open-source password manager. Ardoino slammed cloud security, declaring, “The cloud has failed us. Again.”

PearPass is designed to store all credentials locally on your device, eliminating the risks of centralized storage. The announcement echoes a larger movement toward decentralized, user-first security tools—a trend gaining traction as online identity theft skyrockets.

This isn’t just another password manager—PearPass signals a shift away from vulnerable cloud-based solutions. Expect a public release in the coming months, with its offline nature poised to reshape the cybersecurity space.

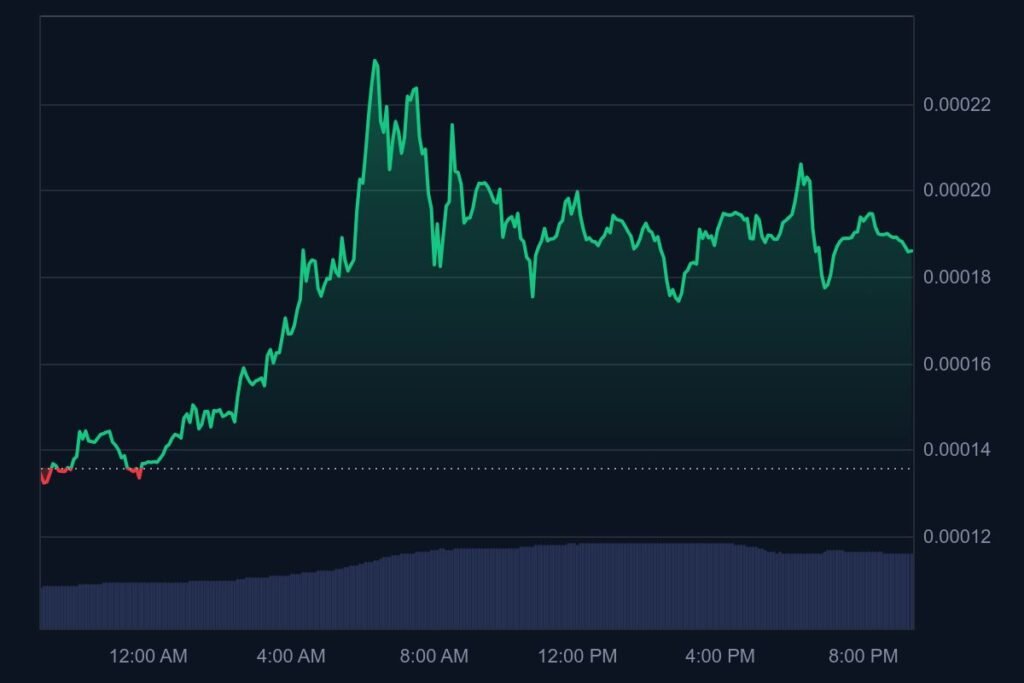

You might also like: GOUT Memecoin Explodes 1000% in a Week — Hits New All-Time High