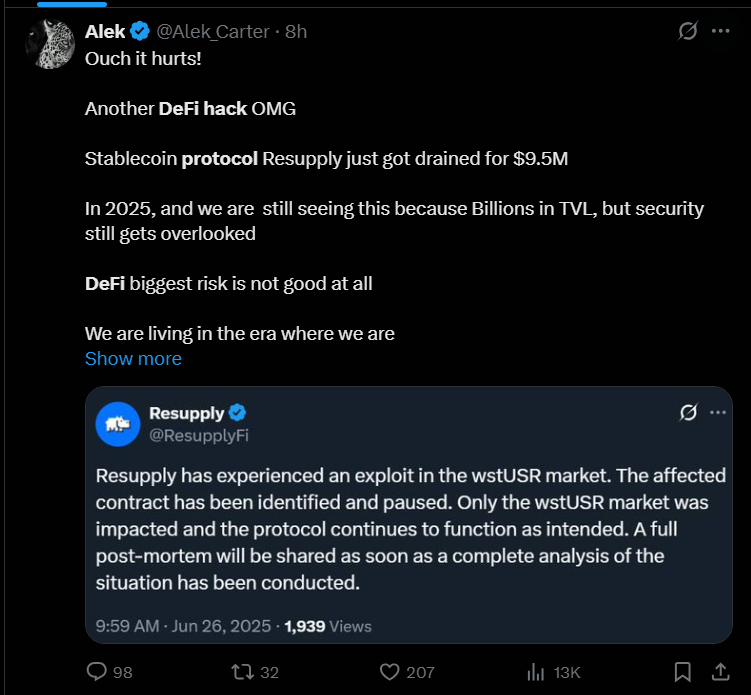

In the latest blow to the decentralized finance (DeFi) world, Resupply, a stablecoin-focused protocol, confirmed it was exploited for $9.6 million. The hack targeted its wstUSR market by manipulating the price of cvcrvUSD, leading to a glitch in the ResupplyPair smart contract.

With just a tiny investment, the attacker managed to borrow a massive amount of reUSD, turning the exploit into a high-reward, low-risk jackpot. The stolen funds were quickly swapped into ETH (~$2M), USDC (~$3.6M), and more. To cover their tracks, the hacker split the funds across two wallets. Classic move.

👉 Only the wstUSR market was affected, and thankfully, the contract has now been paused. Resupply is digging deep into what went wrong and has promised a full post-mortem soon.

This hack is yet another wake-up call for DeFi builders and users. Any reliance on external price oracles or unchecked smart contracts can become the Achilles’ heel. And for investors? Well, this is a reminder: DeFi is powerful, but it’s still the wild west.

Stay safe, anon. 🛡️

You might also like: Memecoin Market Soars Past $53B as DOGE, SHIB, PEPE Lead Rally — WIF, BONK, FLOKI Eye Breakouts