Our latest ETH price analysis explores four pivotal signals that could set ETH on a path toward the $4,000 level. Trading between $3,750 and $3,850, Ethereum is showing signs of both strength and caution. Here’s what to watch:

4 Critical Signals in Ethereum Price Analysis

- Spot ETF Anticipation Boosts Sentiment

Institutional filings for spot ETH ETFs have intensified in recent weeks. Market sentiment is turning bullish as analysts expect approval might come sooner than anticipated. - Staked ETH Continues Rising

On-chain staking data shows an increase of ~2.5% in staked Ether over the past month. With more ETH locked up, circulating supply tightens—supportive for price appreciation. - Cup-and-Handle Formation on Daily Chart

Ethereum’s chart is displaying a classic cup-and-handle pattern, with the “handle” forming near $3,900. A breakout above $3,900–$3,920—especially with volume—could propel ETH toward $4,200. - Macro & DeFi Environment

DeFi activity on Ethereum is ticking higher, with aggregate TVL rising ~5% this week. At the same time, easing macro volatility and expectations of dovish central banks are improving risk appetite.

Quick Take:

This ethereum price analysis outlines a setup primed for upside: ETF optimism, rising staking, bullish chart structure, and supportive fundamentals. Watch the $3,900–$3,920 breakout zone—if ETH clears it with volume, a run to $4,000+ could follow. Failure to hold above $3,750 might lead to a test of $3,650 support.

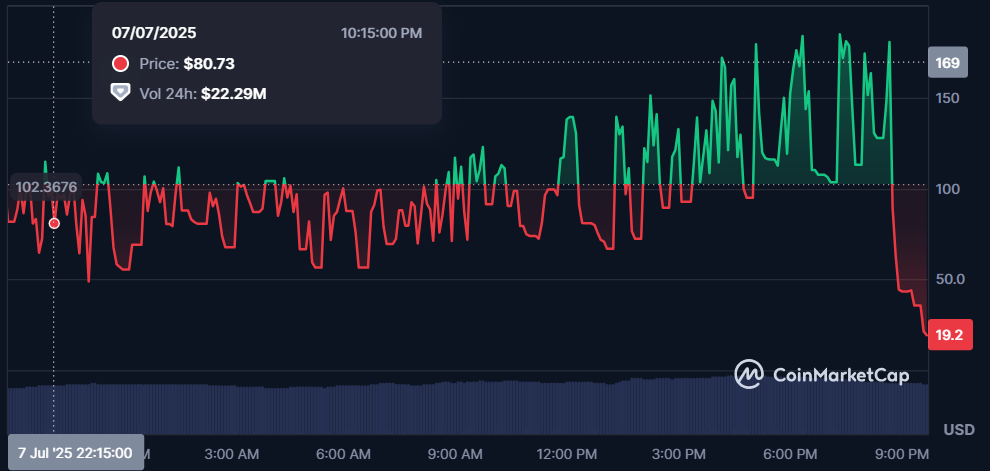

YOU MIGHT ALSO LIKE: Fake Coinbase Crypto Surges 235% in 24H, Sparks Market Chaos