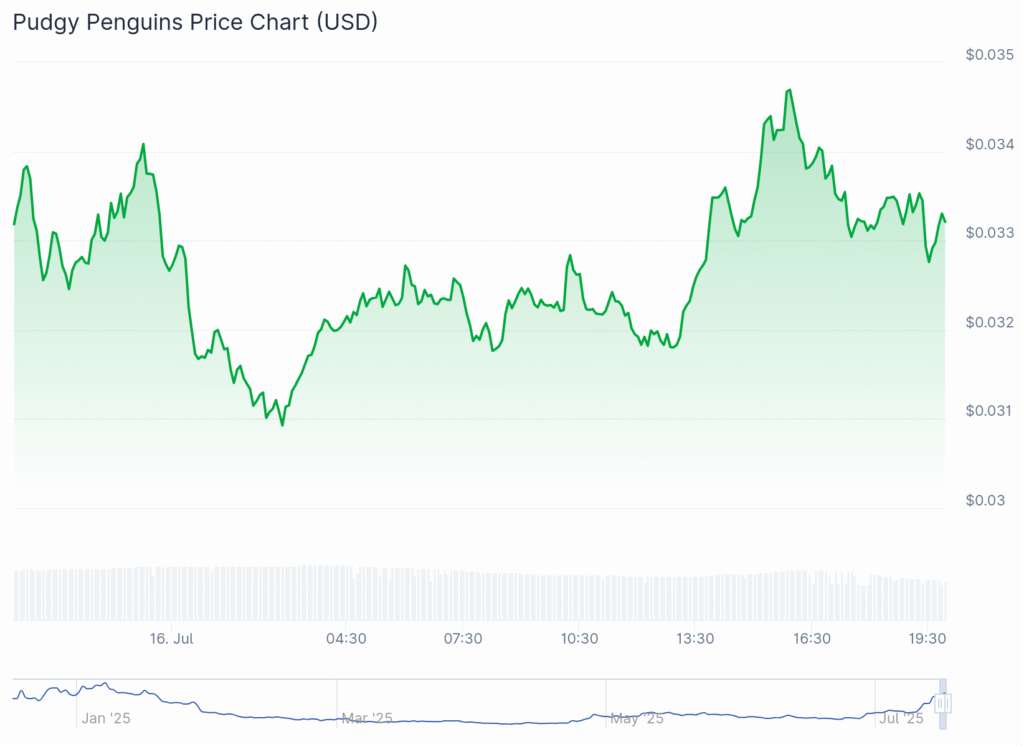

$PENGU is back in the spotlight after exploding 127.4% in just 7 days. In the past 24 hours alone, the token jumped nearly 21%, hitting an intraday high of $0.0344. As of July 15, $PENGU trades at $0.03418, riding a wave of trading volume spikes and aggressive whale accumulation.

What’s behind the surge? Meme coin mania, ETF rumors, and social media stunts.

Originally a niche NFT project, Pudgy has evolved into a multi-dimensional Web3 brand, driven by:

- ETF filings sparking Wall Street attention.

- Coinbase and Binance US using Pudgy avatars.

- Major retail partnerships expanding visibility.

$PENGU now runs on Solana, with a total supply of 88.88 billion tokens, out of which 63 billion are in circulation. Around 26% of the supply remains locked for community rewards, adding a scarcity element that’s boosting investor sentiment.

The biggest development?

The Canary PENG ETF.

Recently filed with the SEC, it proposes a 95% allocation to PENG tokens and 5% to Pudgy Penguin NFTs—a unique ETF structure blending token liquidity with NFT collectibility.

As ETF excitement spreads, retail traders and whales alike are betting $PENGU could be the breakout memecoin of Summer 2025.

You might also like: Ethereum Price Today: 4 Key Signals Hinting at $3,200 Recovery