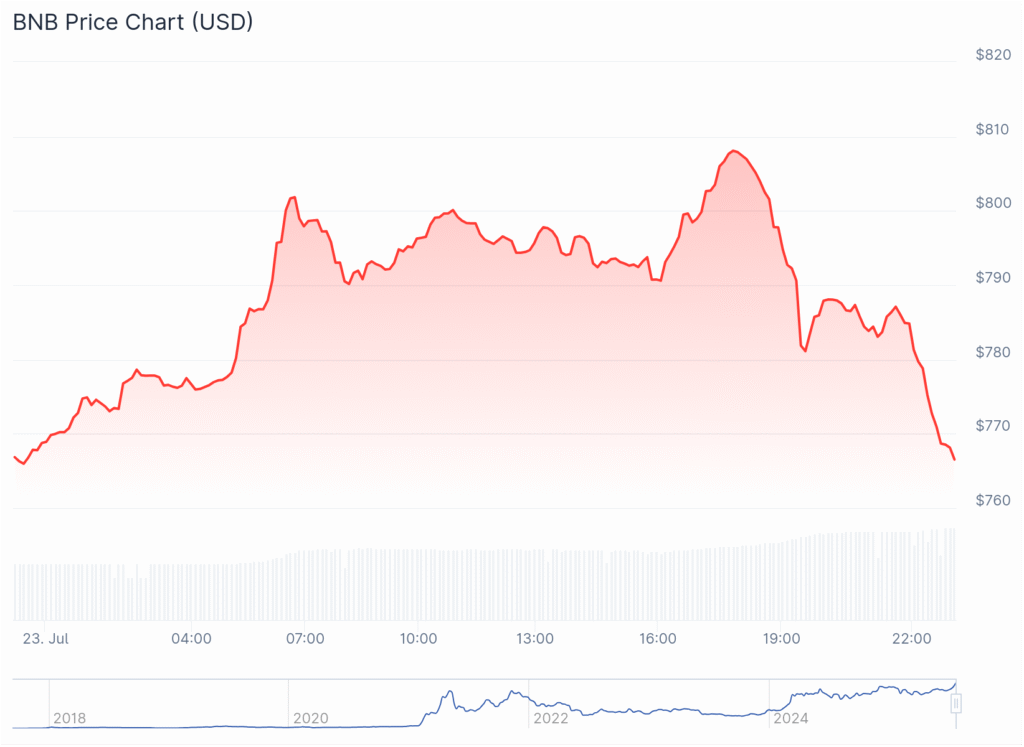

BNB, the native coin of BNB Chain, surged 7% in 24 hours and 16% over the past week, reaching a record $803 in early Asian trading on July 23. This rally pushed its market cap past $110 billion, signaling growing investor confidence.

Trading activity has ramped up, with daily volume increasing 12% to $3.2 billion and futures open interest rising 23% to $1.27 billion, according to Coinglass. Derivatives volume jumped 22% to $2.15 billion, highlighting strong speculative interest.

A major catalyst was Nano Labs Ltd, a China-based Web3 firm, which bought 120,000 tokens (about $90 million) via OTC deals at an average price of $707. The company views BNB as a “core strategic reserve asset” and plans to accumulate more.

Technically, it is trading above its 20-day SMA of $704, maintaining a strong uptrend. However, with the RSI at 87.54 and above the upper Bollinger Band, short-term caution is advised. Analysts suggest it could target $850 next, with $900 as resistance, and support near $740 or $705. CoinCodex forecasts BNB may reach $1,100 by November 2025 if institutional interest persists.

You might also like: XRP Price Prediction: XRP Eyes $4 After Surpassing McDonald’s Market Cap