Robert Kiyosaki: 1929-Style Crash Is Coming

Renowned financial educator and Rich Dad Poor Dad author Robert Kiyosaki has issued a stark warning, suggesting that the United States may be on the brink of a market crash similar to 1929. He urges investors to move away from stocks and traditional retirement plans and instead hold Bitcoin, gold, and silver.

Traditional Portfolios in Trouble?

In a recent post on X (formerly Twitter),Robert Kiyosaki questioned the wisdom of heavily relying on 401(k)s or IRAs invested in stocks, citing recent actions from big-name investors.

“Have you ever wondered why Warren Buffett and Jim Rogers have dumped most of their stocks and bonds?” Kiyosaki asked. “Maybe it’s time to find out why.”

He emphasized his own strategy of holding Bitcoin, gold, and silver, writing:

“I sit tight with gold, silver, & Bitcoin. Good luck.”

Warning of a Great Depression Repeat

Robert Kiyosaki drew a direct line to the 1929 crash and the Great Depression, stating:

“We may be on the brink of another 1929 crash and another Great Depression. America’s debt is out of control. You can only print money to pay your bills… for so long.”

He noted that the U.S. is now the largest debtor nation in history, amplifying the risk of a major economic fallout. His advice was simple:

“Please take care and do your own research.”

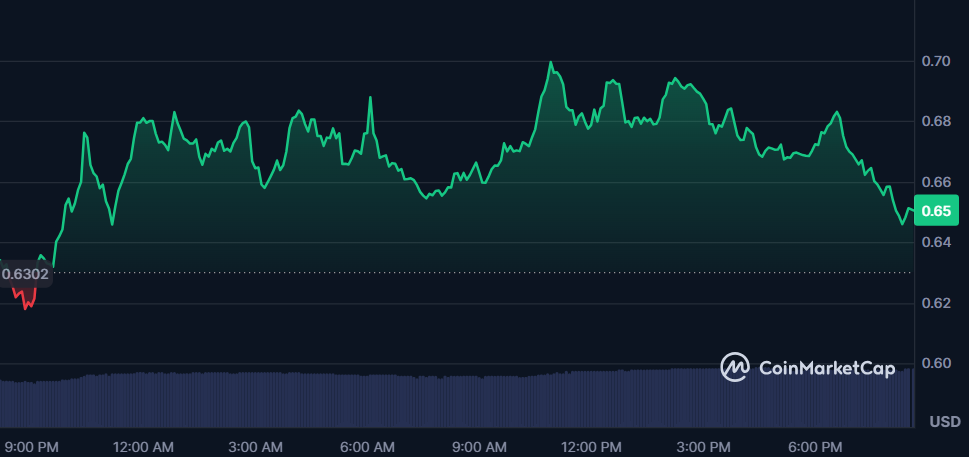

Bitcoin Price Action

As Kiyosaki’s warning circulated, Bitcoin (BTC) saw an uptick in investor interest. As of Monday afternoon, Bitcoin is trading at $118,864.93, marking a 0.6% increase over the past 24 hours.

- Market Cap: $2.36 trillion

- 24H Trading Volume: Up 30.54% to $60.23 billion

The surge suggests growing investor appetite for decentralized assets amid fears of fiat instability and debt-driven collapses.

Why This Matters

Kiyosaki has long promoted alternative assets, but his latest comments echo growing global unease about inflation, mounting debt, and faltering confidence in traditional finance. As central banks continue to print money and interest rate volatility persists, Kiyosaki’s call to action may resonate with a broader audience.

YOU MIGHT ALSO LIKE: Bitcoin Hashrate Hits Record High as Miners Dominate—But Regulators Are Watching